|

| By Jordan Chussler |

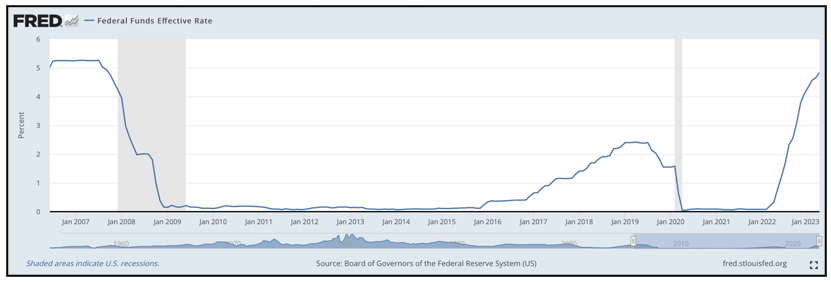

This week, the Federal Reserve raised its benchmark federal funds rate by another 25 basis points, extending its record stretch of interest rate hikes to a target range of 5%–5.25%, the highest level since 2007 and up from nearly zero early last year.

However, there is speculation that this could be the last in a series of Fed rate hikes. After this week’s Federal Open Market Committee meeting, the group omitted a line from its previous statement in March that said it “anticipates that some additional policy firming may be appropriate.”

Click here to see full-sized image.

Still, even with a potential pause to the Fed’s aggressive hikes alongside cooling inflation, headwinds remain for the economy and the markets.

Specifically, the showdown between Democrats and Republicans over the U.S. federal debt ceiling, which could be breached as early as this summer, presents challenges for investors looking to position themselves.

The market, having been rangebound since November, could breakout once the two parties come to an agreement.

However, until clarity on the debt ceiling is established, investors should tread carefully, as we learned this week with the ongoing banking crisis’ latest victim, First Republic, and potentially its next, PacWest, whose shares are down 91.25% from its year-to-date high.

That’s one reason Senior Analyst Sean Brodrick recommends you prepare accordingly and look to certain assets that can hedge against ongoing volatility until the market decides which direction it will turn.

As Congress prepares for a standoff over whether or not to raise the federal government’s debt limit, the result could have an adverse effect on precious metals and, according to Sean, this one ETF in particular.

Learn Our Strategies … from the Sources Themselves

In a year that’s proven unpredictable for the markets, the one constant has been how Weiss analysts and editors deploy safety-oriented strategies, as well as opportunities to hedge with alternative assets. This year, you can meet them in person to learn more about their methodology and tailored picks.

Waiting on the Big Exit in Private Equity

Startup Investing Specialist Chris Graebe explains why the private equity crowdfunding space hasn’t yet seen the big exit investors wish for, and why patience and timing are the two most critical factors in waiting for startups to have successful IPOs or exits.

As Another Bank Bites the Dust, Investors Wonder Who’s Next

If enough people withdraw money at the same time, no bank is immune from the wrath of panicked customers. Director of Research & Ratings Gavin Magor explains the Weiss Ratings’ list of most concerning banks and how First Republic — the latest to fall — was at the top.

How AI Will Drive the Narrative at Google I/O

According to Pulitzer Prize winner Jon Markman, a near-term opportunity is shaping up for shareholders of Alphabet (GOOGL) heading into the company’s annual Google I/O event, and that opportunity is being shaped by AI.

Bad News for BBBY, Good News for 1 Competitor

Senior Writer Karen Riccio explains what caused the downfall of Bed, Bath & Beyond (BBBY) and how the company’s demise creates a market share for one “Buy”-rated competitor.

As the Banking Crisis Continues, Here’s How to Find Safety

If trust in the banking system is broken, trillions of dollars will seek a new, safe home. Senior Editor Tony Sagami reports on how you can protect your money from ongoing bank failures, and one asset class that is poised to hedge against increasing distrust of the banking sector.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily