|

| By Jim Nelson |

Retail investors now make up about 20% of all U.S. equity trading volume.

That’s twice the amount just a decade ago.

Ever since the pandemic locked us all in our homes, the stock market has seen a boom in everyday investors looking to participate more actively in its ebbs and flows.

Add in the fee-free revolution that now let’s even the smallest of trades avoid commissions, and you have a sustaining trend.

Robinhood, the first major commission-free brokerage, keeps track of what its customers are buying.

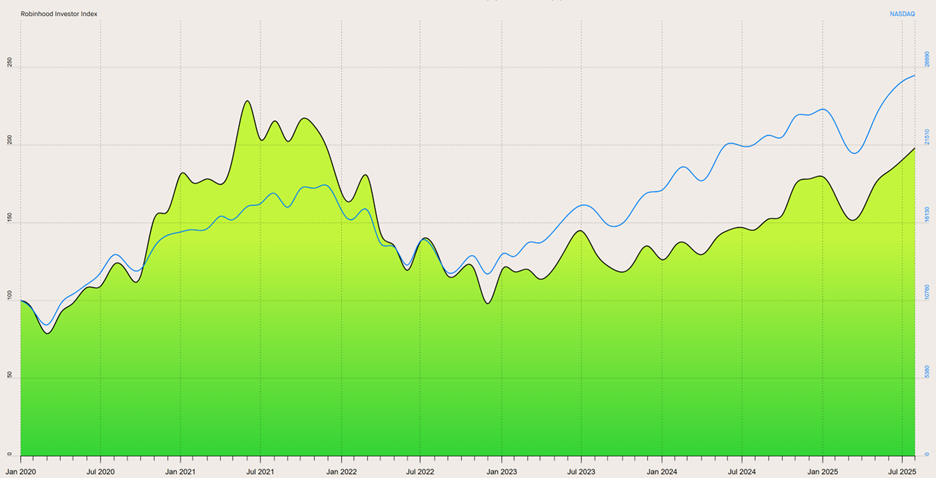

It publishes this as the Robinhood Investor Index, which includes the top 100 most-owned investments on its platform.

But as you can see, since the start of this decade, you’d have been better off just buying the Nasdaq:

Still, with the rise of retail investors’ buying power — we all remember the early meme stock craze of 2021 — what these investors own is becoming more important.

According to Robinhood, its top 10 held stocks are:

- Nvidia (NVDA)

- Apple (AAPL)

- Microsoft (MSFT)

- Amazon.com (AMZN)

- Meta Platforms (META)

- Tesla (TSLA)

- Palantir Technologies (PLTR)

- Walt Disney (DIS)

- Ford Motor (F)

- GameStop (GME)

Most of these are no-brainers.

After Nvidia’s run over the past few years thanks to its stranglehold on AI chips, of course regular investors have gotten involved.

Palantir’s story is similar. It’s up 137% year to date. And business is booming.

But the question we asked ourselves is: “Should you buy any of these right now?”

For that, we have to turn to Weiss Ratings.

Using the Weiss Ratings Plus “Stock Ratings Analyst” tool, you can see a few interesting things right away:

First, about 50% of these are “Buy”-rated. The other half are “Holds.”

And you can drill down from there.

All 10 rate just “Fair” or “Weak” on our Risk Index, which is a proprietary measure we have to judge the risk of a price collapse.

Not great.

However, most gain a much higher rating on our Reward Index, which is self-explanatory.

But I want to focus on the final two columns.

These show where retail investors have departed from conventional wisdom regarding investments.

The majority are trading at wildly high valuations.

Palantir goes for nearly 600 times its earnings. Tesla’s P/E sits at 245.

The S&P 500, which is itself about 50% higher than its historical average, has an average P/E around 30.

But we can chalk most of these astronomical valuations up to growth.

After all, many of these names are seeing double- and even triple-digit revenue growth.

So, finally, let’s look at the last column — Dividend Yield.

Besides Ford, this is just sad.

Only Disney has a payout larger than 1%.

Tech companies aren’t known for their dividends. But a 0.02% yield makes you wonder: “Why even bother?”

Still, we trust our data and the ratings. If dividends aren’t your focus, but solid growth is, you can look no further than the “Buys” on this list.

But we suspect you actually do want to look a little further.

If so, I recommend you first look here.

We set our 7+ terabytes of data into discovering what the next AI superstars are going to be.

Your experts also use these proprietary tools and data to find their own hot ideas.

Here’s what they are seeing right now …

Sure, This Bubble Can Get Even Bigger

Nilus Mattive sees those high valuations above and doesn’t like them one bit. So, he has a recommendation to keep you safe AND profiting.

Sometimes to go up, you need to look down. That’s exactly what’s happening with the boom in rocket launches. Michael A. Robinson gives you a company that is taking space flight into the sea.

If you haven’t jumped onboard the runaway gold train, Sean Brodrick wants to know why. He also gives you more reasons why it won’t stop anytime soon AND how to play it.

Weather Meets Waze … in Space!

To go along with the rocket theme Michael kicked off, your startup specialist, Chris Graebe, has a unique pre-IPO investment idea that takes weather into space.

My AI Prediction Yielded 90% Gains — With More Ahead

When Wall Street misses a story, you can bank large profits. That’s exactly what happened a year ago. Michael says you still have a chance to bank more gains.

Next-Gen Rocket Stocks Are Taking Wing

To wrap up the week, we sent along some insights Sean shared with his paid subscribers. And you guessed it, the boom in rocket launches and defense stocks is nowhere near over.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily