|

| By Jim Nelson |

Investors had an absolutely wonderful week after three months of declining stock prices.

The rally this week sent the S&P 500 up 5.9%, as of yesterday’s early trading. The Dow Industrial Average likewise jumped, adding more than 1,600 points.

In fact, for the first time in what feels like ages, every single sector of the S&P rose in unison … even the much-lagging real estate and utilities sectors.

Why did this happen? Well, two main reasons …

First, the Federal Reserve kept rates where they were.

While not a big surprise, as several Federal Open Market Committee members have been indicating for a while that higher Treasury yields were forcing their hands, the neutral outcome of this week’s meeting did indicate that the Fed is actually watching the real economy.

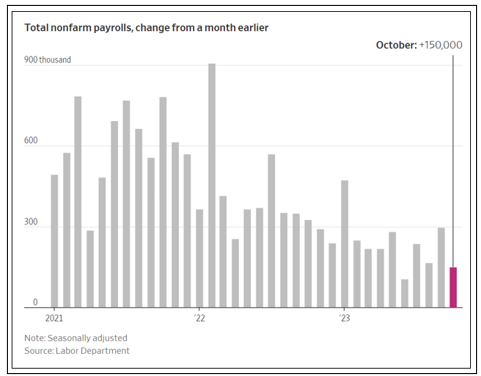

Second, Friday’s jobs report shows significantly fewer new jobs than we’ve seen throughout the year.

New nonfarm payrolls increased just 150,000 during October, about half of September’s total and the second lowest of the year. This further indicates that rate hikes could be over.

No one has a crystal ball here, but it does look like many of our analysts were right that November was going to be a change of tides.

Still, there’s a lot of days left in this month of thanks. Let’s see what our experts had to say to kick it off …

Director of Research & Ratings Gavin Magor explains the best way to handle a chaotic earnings season. Using Weiss Stock Ratings, which updates daily, you can instantly see whether a company was upgraded or downgraded throughout earnings season. Better yet, it can help you find winners and manage downside risk.

‘Just Because You’re Paranoid …’

You don’t have to be paranoid about the government to realize it has a habit of overstepping its bounds. Nilus Mattive explains the newest line that might tempt the U.S. government to overstep … and what he’s doing about it.

November’s No-Brainer Investment

Natural Resources Analyst Sean Brodrick has been hammering the importance of adding uranium to your portfolio for months. If you had taken his advice, you’d already be up 35% compared to the S&P 500’s 18% decline. Don’t worry, though. This is when the REAL money gets made.

Play This Industry Reset in CPUs

Apple (AAPL) lost the race of ultrafast CPU chips. Qualcomm (QCOM) recently released the clear winner. Yet, our tech expert Jon Markman notes that neither company offers the best way to play this finished race. He does, however, show you which company does.

4 Powerful Tools Await You Online

Editorial Director Dawn Pennington takes us on a deep dive into how the Weiss Stock Ratings system came to be. Then, she shows us four amazing features you can use for free that you might not even know about. These four tools can be a powerful advantage for your profit hunt.

That’s it for this morning. Have a great rest of your weekend!

Until next time,

Jim Nelson

Managing Editor

Weiss Ratings Daily