|

| By Jordan Chussler |

Despite mixed reviews from this week’s Consumer Price Index report — which saw year-over-year inflation subside for the seventh month in a row, but month-over-month inflation rise slightly — there are plenty of other indicators showing ongoing strength in the economy and the market:

• Retail sales rose 3% in January, leaving the consensus estimate of 1.9% in the dust.

• Homebuilder sentiment showed the largest MoM improvement by in a decade.

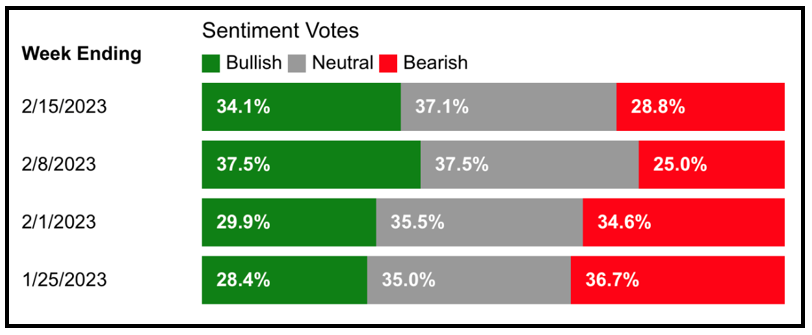

• And for the first time in a very long time, the American Association of Individual Investors’ Sentiment Survey showed bullishness outweighing bearishness for two consecutive weeks, first by a measure of 37.5%–25% and then 34.1%–28.8%.

Click here to view full-sized image.

As the S&P 500 remains steadily above its 200-day moving average — generally regarded as the threshold of bull and bear markets — the index has seen a year-to-date gain of 7.32%. Meanwhile, the small-cap Russell 2000 has risen more than 10% and the tech-heavy Nasdaq Composite is up nearly 15%.

To learn more about where investors can take advantage of this strong start to the year, here are this week’s top stories from your favorite Weiss Ratings experts.

4 Traits I Look for in a Gold Miner

In the final installment of his three-part series on metals’ outlook for 2023 and beyond, Senior Analyst Sean Brodrick discusses the four critical components he looks for when looking for an investment-worthy gold miner.

VIDEO: Market Minute with Kenny Polcari

In his weekly look-ahead video series, Financial News Anchor Kenny Polcari reports on the tail end of earnings season, CPI, retail sales, hourly wages and what they all mean for the market going forward.

Stocks Don’t Fall Far from the Apple Tree

As goes Apple (AAPL), so goes the market. Or so the saying goes. Director of Research & Ratings Gavin Magor says that despite ongoing layoffs in the tech sector, the stock market does not operate rationally. That likely has a lot to do with why it’s leading the S&P 500’s way with a nearly 10% gain in the past month.

AI Is Boosting This Tech Giant’s Shares

Recently, one of the largest companies in the world transformed into a nimble startup, and investors rewarded it with billions in value. Pulitzer Prize winner Jon Markman discusses how this Big Tech company is outpacing others — and being rewarded in doing so — for its big bet on AI.

Rising Used-Car Prices Make This Stock a ‘Buy’

According to Manheim’s Used Vehicle Value Index, the price of used vehicles is again on the rise after subsiding from highs reached during the pandemic. Kenny Polcari says that while this is not good news for consumers, it is good news for this company.

The Cash Furnaces Named Lyft & Uber

Since its five-year high in February 2021, shares of Uber (UBER) are down around 40%, while shares of Lyft (LYFT), which hit its five-year high in March 2019, are down over 85%. Senior Editor Tony Sagami reports on why the more money the two biggest ride-sharing companies bring in, the more they continue to lose.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily