|

| By Nilus Mattive |

It was 1999, and I was fresh out of college, working my first job on Wall Street.

This was back when internet stocks were exploding higher and internet-based message boards were still a relatively novel concept.

So, my two main responsibilities were writing original investment articles and helping the company grow its online community of investors.

In a sense, it was the perfect intersection of researching and writing about tech investments while also directly helping a publishing company transition into the technology space itself.

At night, I sometimes went to lavish parties being put on by other financial firms and tech startups.

Free food, free drinks, cool venues … all I had to do was get my name on a special email invite list for “Silicon Alley” investors and insiders.

Then, one day, the parties ground to a halt.

So did my employer’s business.

It wasn’t all that surprising to any of us.

In fact, I had already gotten my money out of Dot-Com frenzy stocks and had been writing a lot more articles about diversification and far more boring investment opportunities.

Does this sound familiar?

Just in the past three weeks, I’ve told you:

Here we are a quarter-century later. And it seems to be playing out all over again.

But don’t take my word for it.

Just ask Jeff Bezos, a guy who was right there in the actual heart of the 1999 Tech Bubble.

At a recent “Italian Tech Week” event, he told the audience …

"When people get very excited, as they are today, about artificial intelligence, for example … every experiment gets funded, every company gets funded. The good ideas and the bad ideas.

And investors have a hard time in the middle of this excitement, distinguishing between the good ideas and bad ideas.

So that's also probably happening today. But it doesn't mean that anything that is happening isn't real."

I agree with him on all counts.

In fact, even if I’m personally very concerned about the overall direction AI might take in the future, there’s no denying it could make positive impacts on plenty of industries and create lots of wealth for investors in the process.

However, I also think investors have gotten way ahead of themselves just as they did back in 1999. And I expect a major implosion to happen because of it.

To understand why, let me show you a simple curve that I last used in 2022 to predict the massive runup in Bitcoin’s price that has taken place since then …

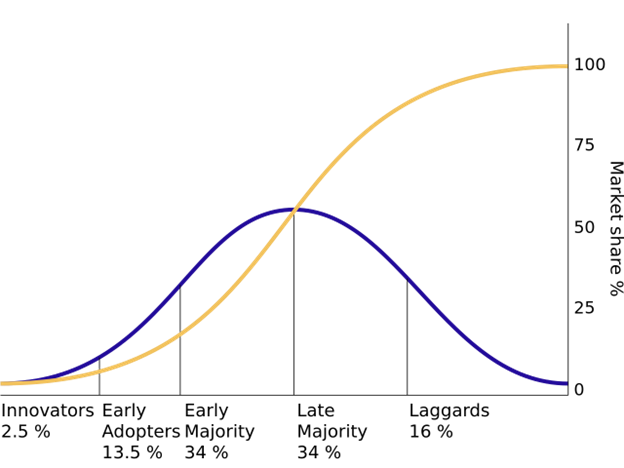

This curve goes by several different names.

But it shows how a major innovation is adopted by a large population of people.

You can see there are very early adopters — industry insiders, tech nerds, dreamers, whomever.

These are the people who were talking to each other on the internet back in 1993 or buying Bitcoin in 2010.

Then there are people like me, who were already buying and selling on eBay back in 1999. Or getting into cryptos during the last bull market.

When you add them to the very early adopters, you’re talking about 15% of the total population.

And what’s important is that shortly after this point, the curve really starts to steepen.

It goes from 10% or 20% adoption to 50% adoption and then 75% adoption in very short order.

Finally, you have the laggards. The last 15% or 16%.

Maybe that aunt or uncle who just refuses to get a smartphone.

Or, in the professional investment world, the Warren Buffetts who don’t get involved until everything is completely proven and modeled out.

The time from early adoption to late-stage adoption has been getting shorter over time.

However, it’s still not instantaneous or even always fast.

And the technology itself is still being refined and perfected as the adoption is happening.

For investors, that’s critical.

Because here’s the thing I’ve come to understand about technological innovation and adoption: Financial markets often make wildly wrong bets UP and DOWN as the adoption curve plays out.

In the case of the internet, the early adopters and visionaries like Bezos clearly saw how it would eventually change everything.

They were also very good at selling investors on that future even if the investors themselves didn’t fully understand the technology or its implications.

The end result was a group mindset, fueled by easy money, funding just about any internet-related project without much concern about the short-term valuations or payoffs.

This all goes very well until it doesn’t.

Maybe the adoption starts taking a little too long.

Maybe a high-profile business runs into a problem.

Maybe it’s an external event that gets everyone rethinking risk.

We never know what the catalyst is that breaks the mass delusion.

But there will almost certainly be some type of speed bump that erodes collective confidence in a trend.

Suddenly, all the investors start to question their bets.

The “greater fool pool” dries up.

And with all the action concentrated into one small area, the unwinding happens quickly and sharply.

This is how the Tech Bubble popped last time.

It is how crypto’s last bear market played out, just when crypto was at the same point in adoption as the internet back in the late 1990s.

And I believe it is how the AI bubble will pop this time.

Bezos seems to believe the same.

Eventually, the AI promises will probably pay off as expected.

BUT the safest time to buy in is after the initial euphoria subsides … when most investors suddenly believe the whole thing has turned out to be a bust.

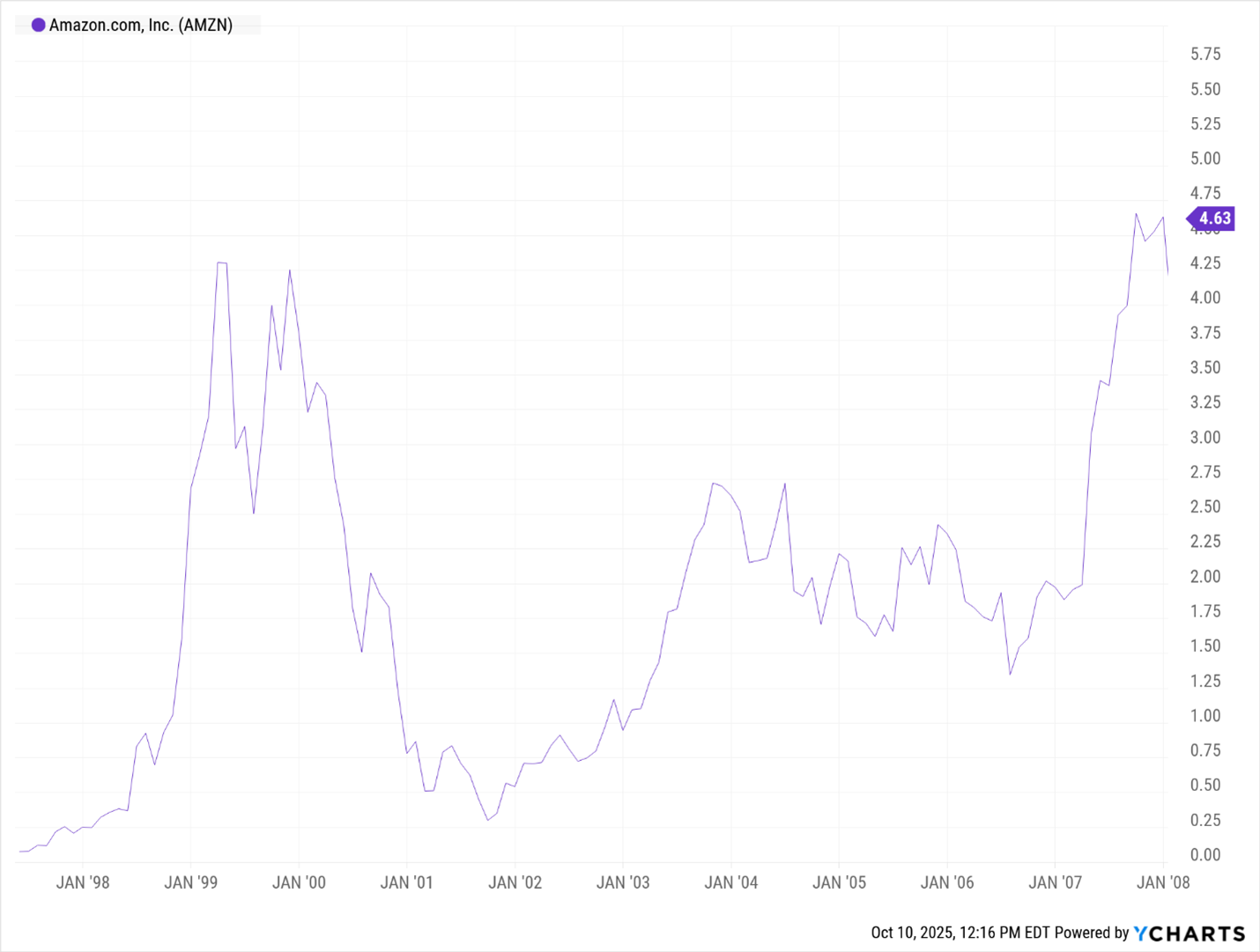

This whole thing is perfectly illustrated by Amazon’s stock, in fact.

From its IPO in 1997 through 2000, the shares went nuts.

Then, when the bubble popped, they lost almost all those massive gains.

And it took about EIGHT YEARS for them to get back to that previous bubble high!

Today, with Amazon up another 11,000%+ … that decade of action looks like a meaningless blip.

So, it’s easy to say, “Hey, everything worked out if you just held the whole time.”

Unfortunately, that ignores how many other internet stocks never recovered at all.

And even in the case of one of the tech bubble’s best survivor stories, it ignores the many long years of paper losses that people had to endure, assuming they even had that much time, flexibility and willpower to stay the course at all.

Best wishes,

Nilus Mattive

P.S. One of the best ways to brace for whatever comes next is to load up a portion of your portfolio in gold and silver.

Fortunately, your resources expert, Sean Brodrick, recently uncovered several individual small gold and silver mining companies set to explode no matter what the rest of the market does from here on out.

Watch to the end to find out how to get those names.