|

| By Jim Nelson |

As you are reading this, Berkshire Hathaway’s (BRKB) annual report is being uploaded.

It will outline how Warren Buffett’s empire has done over the past year, which of its businesses saw growth and other normal annual report stuff.

But it will also include his letter to shareholders. And this year, it’s worth paying attention to.

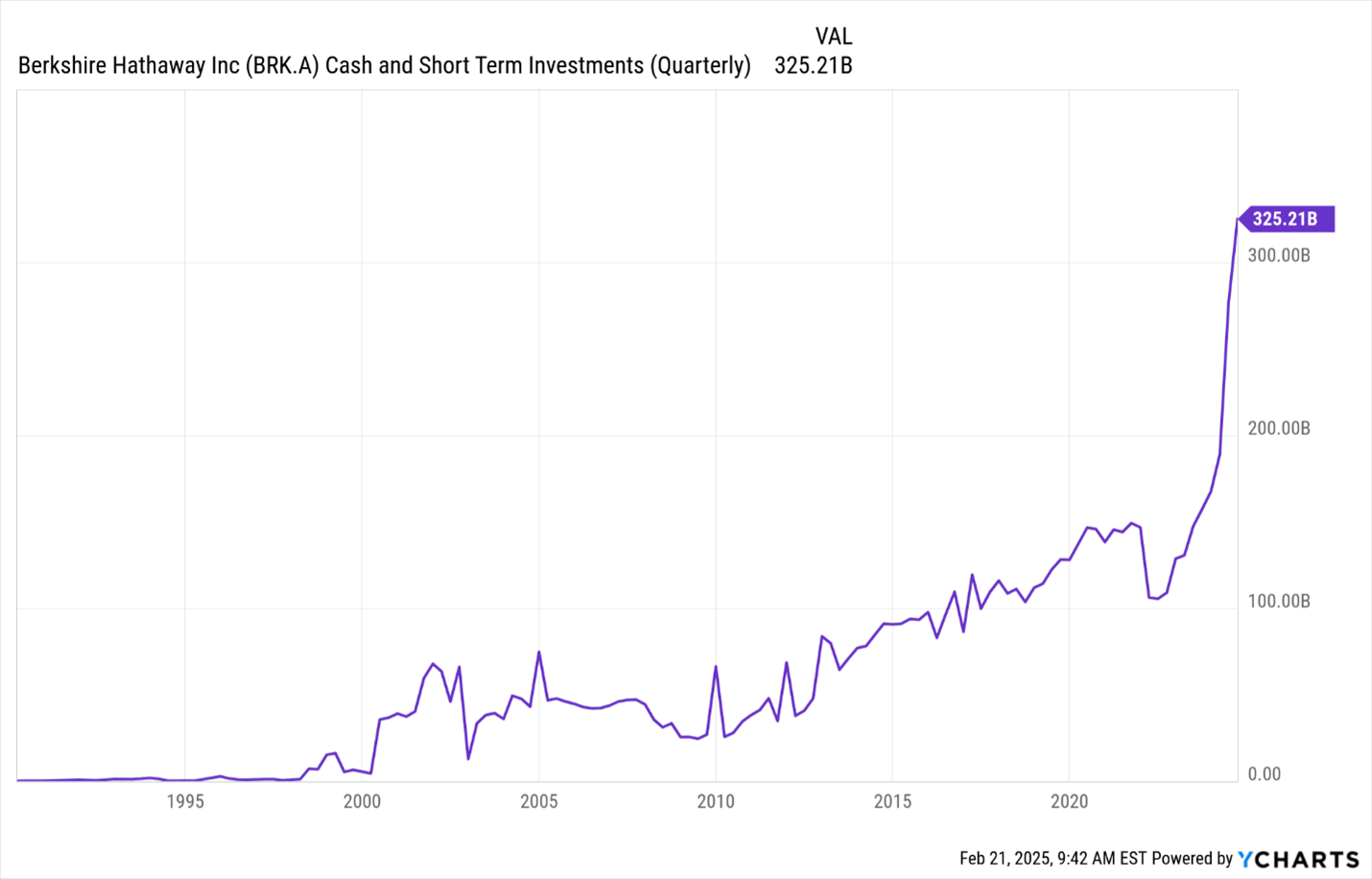

You see, the famed investor’s company just set a new record. It now holds more in cash and Treasury bonds than any company since these specific records have been kept.

In short, Warren is long cash.

Plenty of it came from the income produced by his various holdings and the dividends his company is paid to own those businesses.

But the vast majority of that cash is because Buffett has been a big-time seller for the past several years:

The most notable position Buffett has been offloading is his sizable stake in Apple (AAPL) shares.

The questions about exactly what he plans to do with all this cash are starting to become deafening. And if Buffett is still what he used to be, his answers should be fascinating.

So, it might be a good idea to give today’s letter to shareholders a good read. We certainly will.

Your Weiss experts have their own letters worth reading. And instead of hoarding cash (for the most part), they are giving you ways to grow your own cashflow.

Here’s what they are loving right now …

Are ‘Preppers’ Really That Crazy?

As Buffett is displaying with his cash position, there’s never a bad time to have contingency plans. Nilus Mattive has his own and recommends you do, too.

Buffett is the most notable investor at finding deeply undervalued stocks and buying them on the cheap. But even he knows to not try and catch a falling knife. Gavin Magor has a way for you to avoid them yourself.

Gold is near the crucial $3,000-per-ounce level. And it has some investors a bit panicked about what comes next. Sean Brodrick has the cure for that panic … and it’s more profits.

Follow the (Trump Family’s) Money

Following Buffett’s money trail is a good start. But it pays to follow the money of the most powerful. And another holds that mantle right now. Dr. Bruce Ng has already done the legwork for you.

LA Wildfires Prove This Tech Is Unstoppable

Communication is key to all areas of our lives right now. That’s why this newest innovation needs to be on your radar … and in your portfolio.

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily