6 Things You Need to Know About the SEC’s Lawsuit Against Binance

|

| By Bruce Ng |

Yesterday, the Securities and Exchange Commission unveiled its next plan of attack against the crypto market and sued global exchange giant Binance and its founder and CEO, Changpeng Zhao, more commonly called CZ.

If you would like to read yesterday’s coverage from Marija Matić, please feel free to do so here. And for those of you who are interested in reading all 136 pages of legalese, here is the actual court document.

After having a day to digest this news, I have broken down this case into six key points:

1. The SEC accused Binance of “unlawfully engaging in unregistered offers and sales of crypto asset securities,” and named cryptos such as Binance (BNB, “C”), Solana (SOL, Not Yet Rated), Cardano (ADA, “B-”), Polygon (MATIC, “B”), Cosmos (ATOM, “C”), Algorand (ALGO, “D”) and more. Surprisingly, the list also included stablecoins like Binance USD (BUSD).

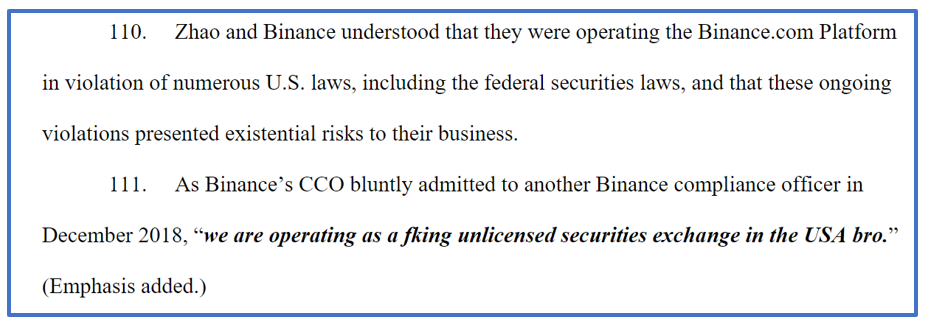

2. In the excerpt below, Binance’s chief compliance officer offers an admission of operating an unlicensed securities exchange in the U.S.:

Click here to see full-sized image.

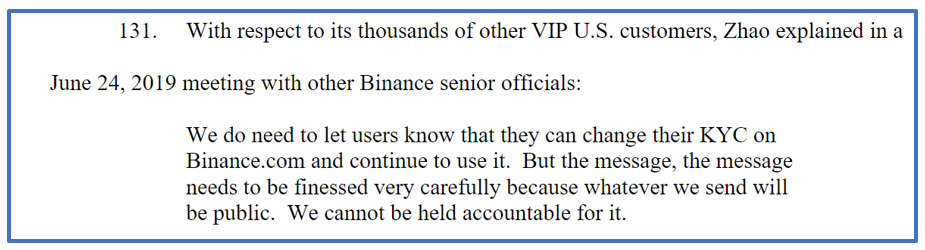

Click here to see full-sized image.3. The SEC claims that Binance’s CEO, CZ, “directed Binance to encourage certain U.S.-based VIP customers to circumvent the new know-your-customer restrictions.” In short, KYC is a mandatory process when providing financial services to verify a person’s identity, financial risk and suitability.

Click here to see full-sized image.

Click here to see full-sized image.4. In a further clause, Binance is accused of internally using market makers that CZ “owned and controlled,” which enabled “manipulative trading on the Binance.US platform.”

5. Next, the SEC alleged that “BAM Trading and BAM Management engaged in acts and practices that operated as a fraud and deceit upon, and made false and misleading statements to, investors.”

6. Finally, it is crucial to note that the lawsuit brought upon Binance is a civil case — not a criminal one. This distinction is important because criminal cases mean jail time and civil cases involve awarding monetary compensation to the plaintiff.

Click here to see full-sized image.

Click here to see full-sized image.

In response to this lawsuit, crypto price action took a plunge.

After the news was announced, Bitcoin (BTC, “A-”) dropped from $27,000 to $25,400. Altcoins also took a big hit, with the total market cap of all altcoins — called TOTAL2 — plummeting 6% from $580 billion to $545 billion.

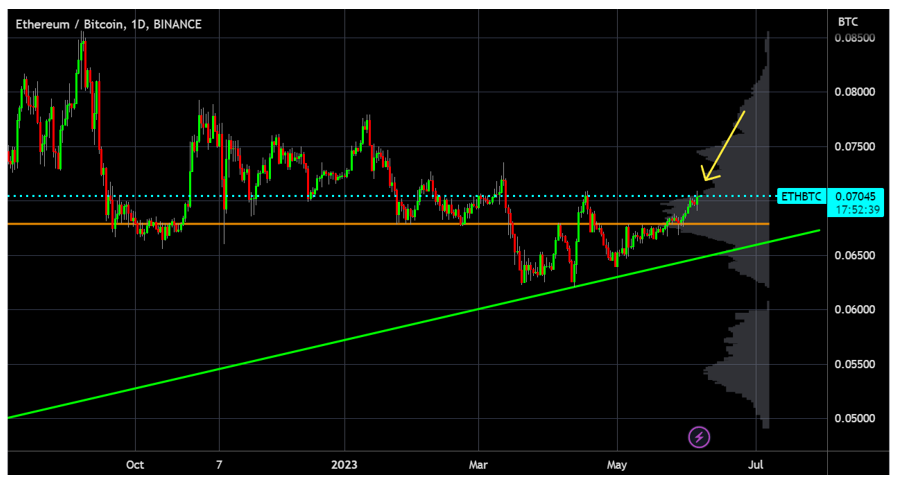

However, one remarkable thing is that the ratio of Ethereum’s (ETH, “B”) price to BTC’s price (i.e., ETH/BTC) remained high.

In fact, it is trying to puncture a key resistance level, which is shown as the yellow arrow below:

Although most alts took a huge beating, strength in ETH/BTC signifies future strength in alts.

Remember, it’s usually bullish when assets show strength in the face of fear, uncertainty and doubt, like the wave created by the lawsuit.

As a testament to this, some of the key alts we are looking at in our Weiss Crypto Portfolio and Undiscovered Cryptos services are holding up well.

Looking ahead, I can see the lawsuit working out in one of two ways:

1. Binance is found guilty, and it must pay some monetary compensation. Prices will tank, but they should eventually recover.

In response, the current mistrust of centralized exchanges will deepen, and users will stay away from them. As CEXes lose market share, users will flock to DeFi protocols, such as decentralized exchanges like Uniswap (UNI, “B-”) and perpetual DEXes like dYdX (DYDX, Not Yet Rated).

This will be bullish for DeFi and alts in general, though adoption may be hindered by the challenges of navigating DeFi if better user experiences aren’t developed.

2. Binance is found innocent, causing crypto markets to rally.

In this case, it makes sense for us to identify the narratives that will rally the most now. The avenues likely to rally the most are:

• Liquid staking derivatives like Lido DAO (LDO, Not Yet Rated) and Rocket Pool (RPL, Not Yet Rated).

• Layer-2 scaling solutions like Arbitrum (ARB, Not Yet Rated), zkSync and StarkNet. As a reminder, a Layer-2 solution is a secondary blockchain built on top of a base chain to increase transaction speed and output without sacrificing decentralization or security.

• Artificial intelligence coins like Fetch.AI (FET, “C+”) and SingularityNET (AGIX, Not Yet Rated).

I have highlighted some narratives that could be bullish here if Binance is able to resolve its legal issues. Additionally, I have written about LSDs and Layer-2 scaling solutions in the past, if you would like to check out those articles.

In the meantime, the entire crypto team will be keeping a close eye on this situation as it unfolds, so make sure to keep up with your Weiss Crypto Daily issues for any updates.

Best,

Bruce Ng