|

| By Beth Canova |

Welcome to our final installment in this week’s “how to trade crypto” series!

We started on Monday with a breakdown of how to convert your cash into crypto using a centralized exchange as an on-ramp.

But centralized exchanges require you to forsake custody of your crypto, and that can be risky.

So, on Tuesday, I introduced you to the world of soft wallets — browser extensions that ensure you, and only you, can access and control your crypto assets.

But being connected to the internet still leaves soft wallets vulnerable to attacks. That’s why I broke down the pros and cons of hard wallets on Wednesday. These USB devices are disconnected from the internet, making them even more secure and a solid choice for long-term storage.

Finally, yesterday I covered the foundation for understanding decentralized finance, the new frontier of the crypto market that focuses on removing middlemen and empowering users to control their own financial destiny.

I said at the end of that issue that I would demystify DeFi platforms. So, without further ado here are two of the biggest players in this field … and the opportunities they offer.

Uniswap: One-Stop Shop for Crypto Swaps

Uniswap (UNI, “B”) is the largest decentralized exchange. Just like a centralized exchange, it facilitates the transaction of cryptocurrencies.

Unlike a centralized exchange, Uniswap never owns or has custody over your crypto or the crypto you’re swapping for.

Instead, it uses a collection of smart contracts that allows users to do one of two things:

- Trade

- Provide liquidity

The key to this strategy is Uniswap’s liquidity pools.

Liquidity providers deposit their crypto into a corresponding pool on Uniswap, which is operated by a smart contract. That pool then keeps track of all the reserves for that specific crypto. Reserves and prices are updated automatically by the platform’s smart contracts every time someone trades.

That’s how Uniswap can facilitate its trade without ever owning the underlying assets — by pulling from the liquidity pools and letting the algorithm run the pools.

And because reserves are automatically rebalanced after each trade, a Uniswap pool can always be used to buy or sell a token.

And since Uniswap isn’t centralized and doesn’t have to own any crypto itself, it can list smaller cap cryptos and projects that can’t be bought on any centralized exchange, offering more variety and opportunity to traders.

(Indeed, targeting small cap cryptos on decentralized exchanges to get exposure before they can achieve the mass adoption of a centrally listed asset is a trading strategy. You can learn more about that here.)

And since Uniswap was built on the Ethereum (ETH, “B+”) blockchain, it can support any Ethereum-based token and all transaction fees are paid in ETH.

There is a drawback to being on the Ethereum network, however. And that’s the blockchain’s tendency to bottleneck transactions during times of high activity. That means transactions get more expensive and take longer to process.

But Uniswap has adapted quickly, setting up support for additional chains, including Layer-2s such as Polygon (MATIC, “B”) and Arbitrum (ARB, Not Yet Rated). This means that traders can now review the details of the same transaction on multiple chains to find the option that costs the cheapest or runs the fastest.

You can’t do that on a centralized exchange!

Meanwhile, the liquidity provider gets a reward — a percentage of the transaction fee paid by the swapper. If there is a higher trading volume for an asset you provide, then the reward you get increases.

And just like with transactions, liquidity pools operate on the different blockchains supported by Uniswap. Smaller chains like Polygon or Arbitrum often offer higher rewards than Ethereum to entice providers to choose them since trading volume can be lower.

This gives providers more options and more opportunities for gains that can’t be matched by anything in TradFi.

(If you’re interested in learning more about liquidity providing as an investment strategy, click here.)

This automated market maker approach that runs on smart contracts has made Uniswap incredibly successful. It dominates the decentralized exchange market with a total value locked of roughly $3.77 billion.

And no wonder. Uniswap’s user-friendly interface is easy to use. It only takes three steps.

- Go to its website and click Launch App in the top right corner.

- Then, connect your soft wallet by clicking Connect, again on the top right.

- Now you’re ready to transact by clicking Swap at the top left. You can get an overview of all supported cryptos available for trading by clicking Tokens. And if you want to be a liquidity provider, click on the three dots to expand the toolbar, then select Pools.

Note: Your soft wallet and Uniswap have to be operating on the same network to connect. The default for Uniswap is Ethereum (as you can see by the icon next to the Connect button). This is why we tend to recommend MetaMask for DeFi. As an Ethereum-based soft wallet, its default is also the Ethereum network.

If you do need to change the network of Uniswap to match your wallet, click on the Ethereum icon next to the Connect button and select the correct network from the drop-down menu.

Aave: Borrowing Without the Bank In Between

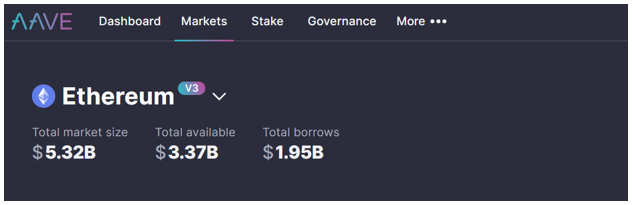

Aave (AAVE, “B”) is a decentralized lending platform where users become suppliers and borrowers, cutting middlemen like banks out of the process entirely. It currently supports 17 crypto assets to lend or borrow.

Just like with liquidity providers on Uniswap, suppliers on Aave provide liquidity to the market to earn a passive income.

Their funds are stored and allocated according to the smart contract, which is visible to the public and has been formally verified and audited by third party auditors. Suppliers can also withdraw their assets on demand, so there’s no obligation to stay in if you no longer want to.

The difference with lending on Aave is that, instead of getting a piece of the pie via transaction fees as Uniswap’s liquidity providers do, suppliers on Aave are paid the interest rate of the loan based on the utilization rate — i.e., how many people are looking to borrow that asset.

The more people who borrow the asset, the higher the utilization rate and the higher the reward for suppliers.

Just one caveat: The suppliers of a single asset share those interest rate payments as a group. So, an overcrowded supply pool can also mean a smaller piece of the pie.

On the other side of this setup are the borrowers. Often, users borrow to get liquidity quickly without needing to sell a long-term investment prematurely. Another potential reason is to gain access to assets without needing to own them outright.

For example, you can post $100 of collateral via a stablecoin like Dai (DAI) on Aave. As a stablecoin, the value of that DAI is not likely to change, no matter what happens in the market. That means you’re protected from impermanent loss — i.e., the value of your collateral decreasing while it’s locked up.

In exchange, you take out a loan for $100 worth of ETH.

Now, you can take that borrowed ETH and stake it on a platform like Lido (LDO, Not Yet Rated), which is a liquid staking platform, to earn passive income from your ETH … all without ever actually paying for the ETH and subjecting yourself to market volatility.

When it comes time to repay your load, just unstake the ETH and return it. Then you get back your $100 in DAI and get to keep the rewards from your ETH staking, minus any transaction fees.

Of course, Aave has to protect itself from defaults. That’s why its smart contract demands borrowers deposit collateral equal in value to what they borrow. The algorithm also prevents borrowers from taking any more than the value of their collateral.

In addition, Aave’s smart contracts monitor the value of your collateral against the value of your borrowed assets and grade the “health” of your loan. If that grade slips too low, your collateral is liquidated unless you either deposit more collateral assets or repay part of your loan.

This ensures that the money provided by suppliers will always be able to be repaid, even if the borrower loses everything or tries to act in bad faith.

Not only that, Aave has a reserve treasury that is currently valued at $133 million and yet another safety protocol to act as a backstop against insolvency that is currently valued at $437 million.

Despite this, no platform is 100% risk-free. Smart contracts can be susceptible to bugs or hacks, and that could really do damage in Aave’s case.

However, the platform is dedicated to security. It has been audited by six of the world’s leading security firms and has an ongoing “bug bounty.”

This program incentivizes users to try and find bugs in Aave’s code before it becomes a problem. If a bug or vulnerability is found, the finder is rewarded based on how severe the issue could have been.

With so many eyes looking for problems, it’s easier to prevent them.

Just like Uniswap, Aave’s latest user interface is fairly simple to navigate. And the steps are mostly the same. Just go to the Aave website, click Launch App in the top right corner, then click Connect Wallet in the top right corner to connect.

Then, you’re free to explore the platform.

The Markets taballows you to see all the assets you can loan or borrow, along with the APY you could get for lending that asset. Clicking on the asset gives you a more detailed breakdown of how much supply there is, how much people are borrowing, how much is available to borrow and what the liquidation threshold for that asset is.

Aave is also built on the Ethereum network, so any Ethereum-compatible wallet will work just fine.

And, if you want to change to a different supported network, just click on the Ethereum icon and select from the drop-down list, remembering to change your wallet to that network as well.

1 Other Way to Play DeFi

This new frontier of finance isn’t going anywhere. The total value locked in all DeFi platforms currently sits at $54 billion.

At the height of the last bull market in December 2021, that reached as high as 247.48 billion.

Looking ahead to the bull market we’re just entering now — after two years of rigorous testing, expansion and development — I anticipate we’ll see the DeFi world grow again. Meaning plenty of opportunities for investors.

And if you’re still weary of navigating the DeFi space by yourself, you can still benefit from the sector’s growth by purchasing a DeFi platform’s token.

UNI and AAVE, for example, both trade on centralized exchanges. You can pick them up and get a piece of their platforms’ success all without exposing yourself to the wild west of DeFi itself.

That wraps up our crypto crash course week. Of course, there are so many other exciting things to talk about when it comes to crypto. And our analysts will be back next week to bring you those new developments and intriguing strategies.

But don’t discount the power of knowing the basics. Understanding how to access the crypto space and navigate it with confidence will mean you’re better prepared to take advantage of the opportunities our analysts find.

I hope you bookmark these articles and use them to help you take your next steps in your crypto journey.

All the best,

Beth Canova

Crypto Managing Editor