If You Think Bitcoin Is Amazing, Wait Till You See This …

|

| By Bruce Ng |

Bitcoin (BTC, “A”) took the crypto world for a wild ride yesterday as it made a notable run toward its all-time high established back in 2021.

As my colleague Marija Matić announced yesterday, this is an incredibly bullish move. We have never approached an all-time this early in a bull cycle.

Truly, BTC’s performance YTD is spectacular.

But my focus is on altcoins — any crypto besides Bitcoin (and Ethereum (ETH, "B") according to some experts). And as an altcoin picker, my job is to pick the fastest growing ones that are most likely to offer the profit opportunities the wild west of crypto is known for.

See, even if Bitcoin soars to hit the $100,000 level this market — breaking the psychologically important six-figure mark — that would only represent a 1.5x increase from current prices.

Let’s say BTC shoots to the moon and manages to hit $200,000. Impressive, right? But it would still only be a threefold increase from today’s trading prices.

I don’t know about you. But I’m in the crypto market to make substantial amounts of money. I want to target the types of gains only possible in the crypto market.

And altcoins are the assets most likely to deliver.

I have teased an alt season for the past month or so in my Weiss Crypto Daily updates. That is when Bitcoin takes a step back and altcoins outperform and lead the market.

And I think alt season is likely to occur very soon for two key reasons.

Reason 1: BTC dominance topped out.

The chart below tracks Bitcoin’s market dominance by measuring the percentage of BTC’s market cap of the total crypto market cap.

As you can see, Bitcoin’s dominance has locally topped at 55%.

In previous times when this level has been hit, it retraced back. BTC.D is now at 54%. If it continues to pull back, we will be in full blown alt season.

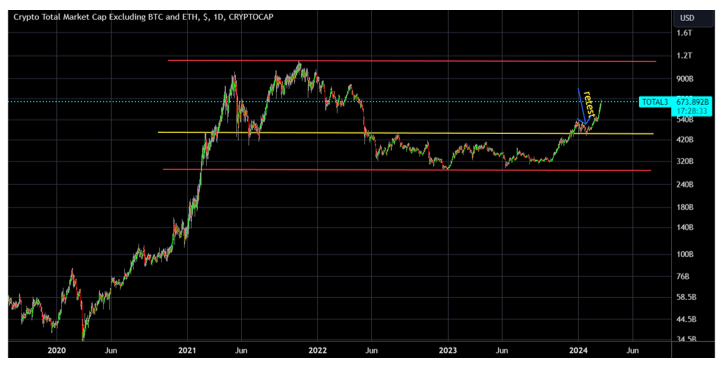

Reason 2: TOTAL3 bounced off support.

TOTAL3 represents the market cap for all altcoins, so the entire crypto market minus BTC and ETH.

In the chart above, you can see that TOTAL3 recently retested support before it started to climb.It currently sits at $673 billion after sitting at $573 billion last week.

That means altcoins saw an increase of $100 billion in market cap in just one week!

This is squarely in bullish territory.

But check any crypto dashboard and you will find that there are thousands of altcoins. My last count was 12,000. And there are now over a dozen sectors.

So, how do you pick the best altcoins to ride up this altseason?

By following the narratives.

In a bull market, when everything is going up, the sectors outperforming will be the ones with powerful narratives driving investor interest.

Last week, I broke down the 10 sectors likely to receive the most attention. Now, that’s a broad overview. But a look at recent headlines and price action reveals which to narrow in on.

Last week, both pointed to memecoins as the prevailing narrative.

That’s right. These coins with no fundamental utility and subsist only on culture, community and hype have been going crazy …

- Bonk (BONK, “C+”), which we still own, went up 200%

- Pepe (PEPE, Not Yet Rated) went up 322%

- Dogswifhats (WIF, Not Yet Rated) went up 217%

- And the old familiar Dogecoin (DOGE, “B-”) went up 107%

Indeed, over the past week, memecoins outperformed the entire market, including BTC. They’ve even been the topic du jour on Bloomberg:

But almost as fast as it exploded, the memecoin craze is bound to fade away and be replaced by another narrative.

So, which could pump next? Well, I’ve currently got three on my radar:

- AI

- DeFi

- Layer-1s (Specifically modular Layer-1s)

However, timing liquidity rotations — the shift from one narrative’s domination to another — is like throwing darts at a moving board. You can only make guesses and never predict with full certainty what’s the next hype train.

That’s why my colleague Juan Villaverde uses his Crypto Timing Model in addition to the narratives to target the best times to buy and sell the coins leading each narrative in his Weiss Crypto Investor newsletter.

If you’re interested in learning how you can get access to those specific “Buy” and “Sell” recommendations, click here.

Best,

Dr. Bruce Ng

P.S. Crypto isn’t the only way to make outsized profits. Early investment opportunities in the traditional finance market can also offer opportunities unlike what you can find anywhere else.

Weiss Ratings’ Chris Graebe is an early stage investing expert. He and our team use our reams of data, technical know-how and models to pinpoint the best possible new private equity or crowdfunding deal there is each quarter.

To learn more about how Chris targets these opportunities and his favorite new private deal, I suggest you watch his latest presentation.

Hurry, though. It’ll be taken offline soon.