Weiss Crypto Daily

Free daily updates from the creators of the world’s first and only cryptocurrency ratings by a ratings agency. The next likely moves in Bitcoin. The most promising altcoins. Forecasts and analysis of crypto technology, adoption and market trends. The latest on decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

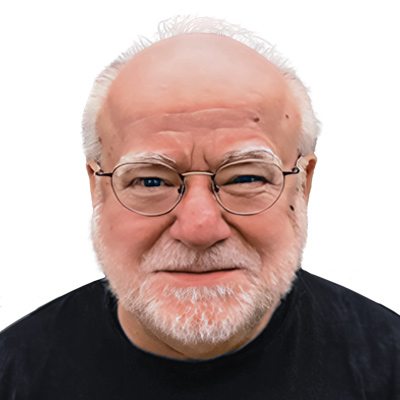

About the Editor

When econometrician and pro trader Juan M. Villaverde first applied his algorithms to Bitcoin, he discovered a regular cyclical pattern. He has since used it to build the world’s first crypto timing model based on cycles. That model has gone 3-for-3 in pinpointing the moment in time when his favorite cryptos were primed for the parabolic phase of the crypto bull market. Just in his monthly letter alone, the average gain on all his crypto trades is 309%, or 4.1x on 29 closed trades.