|

| By Jim Nelson |

Thursday saw the largest drop in the S&P 500 since March 2023 in anticipation of yesterday’s better-than-expected jobs report.

But it’s the companies that are falling the most that’s interesting … and those actually gaining.

Tech stocks continue to suffer from profit-taking after their banner 2023 and early 2024. Our own Sean Brodrick has been calling this for the past two months … and says it will end soon.

But the market has been up despite this. Why?

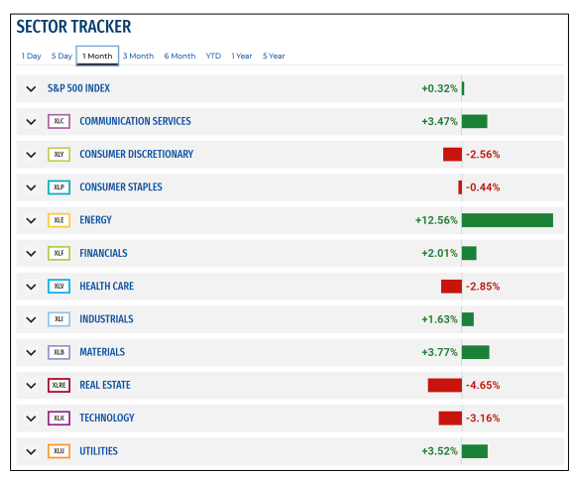

Let’s check in on one of my favorite top-down views of the market — Select Sectors SPDR Sector Tracker:

As you can see, the past month has been lousy for tech. Real estate also remains in investors’ doghouse — due to recent rising mortgage rates. But the real story is on the other side of the profit sheet … energy stocks are exploding.

West Texas Intermediate, or WTI, crude oil is soaring — jumping above $86 this week. That’s significantly higher than its low point in December, when you could buy a barrel for less than $70.

Part of this is due to rising violence in the Israel-Hamas war. But a lot has to do with OPEC+ — the cabal of mostly Middle Eastern oil producers plus Russia — cutting production rates.

Combine all of that with the targeted attacks on Russian refineries and energy exports infrastructure and you can see why prices are up.

Hopefully, you’ve been following along and taking advantage of Sean’s recommendations here and here. If so, your energy profits should make up for any profit taking in your tech portfolio.

Now, let’s see what our experts are recommending this week …

Which would you prefer — a one in 40.6 billion odds at $1 billion or 96 chances at 10,000+% gains … with more to come? If you’re reasonable, you’ll want to hear what Dr. Bruce Ng has to say about this unique niche in the crypto market.

2 ETFs to Pay Your Skyrocketing Insurance Premiums

It’s no secret that our Research & Ratings Director Gavin Magor has been digging deep into skyrocketing insurance premiums of late. Now, he’s found two ways to profit from your own rising auto insurance.

Watch Gold Miners Go Ballistic!

Gold just hit $2,300 for the first time ever this week. Our resources guru Sean Brodrick has the perfect way to play it from a lagging group of gold stocks. You aren’t too late to this party!

Buy This Unusual Backdoor to AI Profits

You’ll probably recall Chris Graebe predicting that 2024 will be the year of AI startups. Well, now our resident tech expert, Jon Markman, has the perfect — and uniquely backdoor — way to play this boom in AI IPOs.

Buy into the Mother of All Bull Markets

Don’t let FOMO get you down, especially since the best of crypto opportunities are still on the table. Forget Bitcoin. Crypto & Cycles Analyst Juan Villaverde has the scoop on “new crypto wonders” that could bring gains of 10,000% or more!

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily