|

| By Jim Nelson |

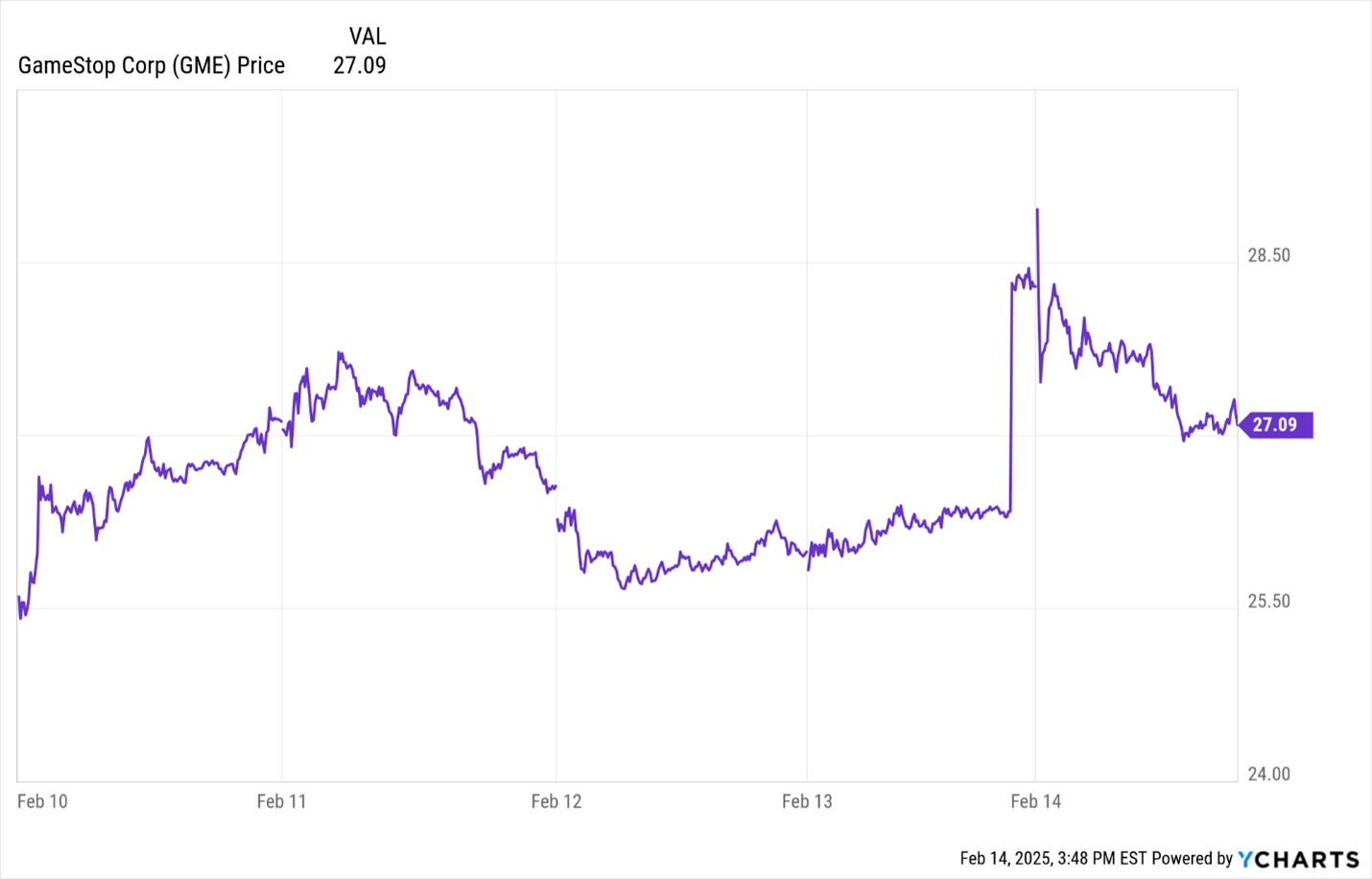

This week, a photo of GameStop (GME) CEO Ryan Cohen and MicroStrategy (MSTR) Chief Exec Michael Saylor appeared online.

And it caused a trading frenzy.

Why a frenzy? After all, GameStop is a meme stock that had its 15 minutes of fame. And MicroStrategy is essentially just a holding company for Bitcoin.

But it sparked insiders at GME to hint that they might just be about to dump their $4.6 billion in cash reserves into crypto … following MicroStrategy’s lead.

And it was off to the races for GME.

The king of crypto, Bitcoin, was the only one named as a possible destination for some of that money.

But other digital currencies could also get a piece of both GME’s questionable cash pile and the meme stock’s wild following’s attention.

We’re not here to speculate what GameStop will buy, how much it will spend, and what kind of boost that could bring to the crypto markets in general.

But if the people holding its purse strings are looking for a sound destination for their crypto investment dollars, our Weiss Crypto Team has several ideas.

As a matter of fact, if Cohen and his team can hold off just a few more days, they can attend our next special event — “The Great 245x Crypto Anomaly Emergency Summit.”

I have an even better idea. That is, for you to gain your edge over these guys.

And you can do that right now by claiming your free spot here to this timely crypto investing event.

Sizeable price fluctuations like GME don’t only happen to meme stocks …

Fortunately, you have experts here at Weiss Ratings who can spot not just sizable … but also SUSTAINABLE … jumps.

Ones you can get on board for without having to be glued to your phone or TV!

Sneak Peek at Our Expert Roundtable

If you only knew what we get to see every week here at Weiss HQ, you’d be green with envy.

This week — like every week — we held a full roundtable discussion with our experts.

We’re supposed to be grilling them for their newest, hottest ideas.

But, in reality, they don’t give us a chance … they can’t wait to speak first.

This week, we heard each editor conclude that volatility is here to stay.

They also noted that they are here to stay, too — and they are working even harder to bring you ideas that can help you sleep at night while also giving you a reason to wake up and look at your portfolio.

While we’ll leave it to each editor to make the case themselves, what they are writing about speaks volumes.

Nilus Mattive — your Safe Money expert — kicked the week off with a list of “freebies.” Clearly, he’s looking to build income and cashflow in the face of this volatility any way he can.

Gavin Magor — the director of our research and ratings department — is looking at silver as a way to hedge (and profit) from this volatility.

Sean Brodrick — your commodity bull of late — takes the other precious metal (gold) and finds the best way to make it shine.

Mark Gough — a new name in these pages, but certainly not in the world of crypto — introduced not only an alternative asset to help against TradFi volatility … but an actual “Wall Street 2.0.”

Michael A. Robinson — who may or may not have been the final piece to declare this wild volatility as something we’ll need to get used to — has a fifth alternative. If AI is going to get shaken up, load up on this “twofer” that wins no matter what.

In short, that’s five experts in different fields saying essentially the same thing: Volatility is here. It is staying. But there are other assets that will go up anyway.

And on Tuesday, yet another expert on our team has an even better way to take advantage of this environment. I urge you to check it out by grabbing your free spot here.

That’s it for this week.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily