|

| By Jim Nelson |

The Federal Reserve just did the most “Fed-like” thing you can imagine.

This week, the central bank decided to forgo another rate hike. In the next breath, it indicated that one more is indeed coming this year.

While this isn’t a huge shock to anyone paying attention, that wasn’t the only news that came out.

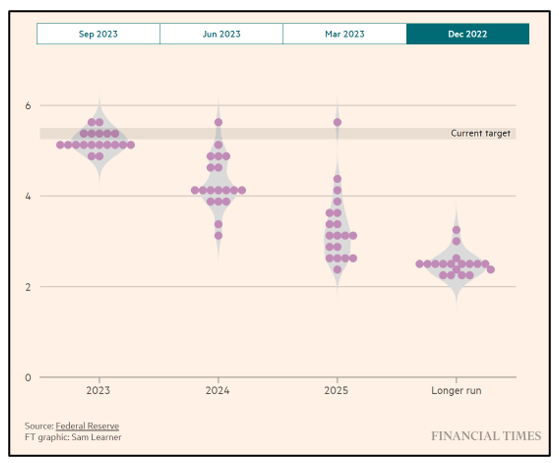

Every time the Federal Open Market Committee has a live meeting, like this week, it releases a “dot plot.” This is a chart that shows the members’ projections for the target rate going forward. It’s like company guidance but for interest rates.

Take a look at where the dot plot was in December of last year:

Take a look at where it is now:

As you can see, the dots — or FOMC member projections —jumped higher for the next several years. This is where you get the term “higher for longer.”

That’s where interest rates will be for quite some time … higher.

Investors didn’t like this. Though, it makes one wonder if they have been paying attention at all. This was never going to be a quick, one-year fix to the spiking inflation rate.

The market ended the week much lower than it began. Shares across the board fell hard immediately following this announcement and continued falling through Thursday.

Maybe this weakness is why so many of your Weiss experts have been discussing alternative assets and strategies to profit from despite the current market mood.

Read what they had to say over the past week …

Time is certainly cyclical, at least when you’re an investor. Dr. Martin Weiss lays out an eerily comparison between the boomtimes of the 1920s — just prior to the worst economic times of modern history — and today. It’s not just the economy either. The ties between these times are deep.

How to Literally ‘Drive’ Your Profits

Investing is so much more than being able to pick the right stocks or bonds. There are alternative assets out there making enormous yearly gains you might not have ever thought about. Alternative Asset Expert Nilus Mattive shares one of his personal favorites that he has a long history with.

Our resource expert, Sean Brodrick, dives into what exactly is happening with gold. Why does it seem stuck? And where does it go from here? He found the one chart you need to see that explains what happens next with everyone’s favorite yellow metal.

Keep the Chips Powering AI on Your Radar

While everyone is so focused on Nvidia (NVDA) and its remarkable performance due to the AI explosion this year, they are forgetting that another crucial piece of hardware is required for the technology. Our AI expert, Jon Markman, explains the single best company to play this other side of the AI story.

Play the Biggest ‘A-‘-Rated Winner on the Fed’s Proclamation

Not everyone loses when interest rates are raised … and stay raised for long periods of time. That’s what the Fed announced it plans to do — keep rates higher for longer. Our Weiss Ratings chief, Gavin Magor, shows you the best way to play this elevating ratings environment.

Until next time,

Jim Nelson

Managing Editor

Weiss Ratings Daily