|

| By Jim Nelson |

With prices for many investments at or near all-time highs, something strange is happening.

Boards of directors are getting anxious.

With limited runway for further growth, they are making major moves.

I’ll point out two recent stories in the Wall Street Journal.

Then, I’ll show you a tool to play this trend.

First, media companies are consolidating at record speed:

You might recall, Skydance only recently bought Paramount for $8 billion.

This new proposal for Warner Bros. would be even bigger.

Skydance isn’t alone.

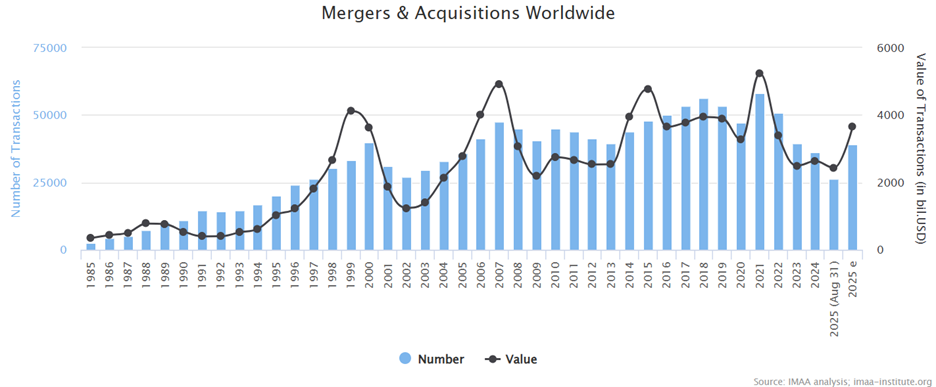

After peaking in 2021, merger and acquisition (M&A) activity has been falling.

But with this deal and others like it, the appropriately-named Institute for Mergers, Acquisitions & Alliances reports a sharp rebound this year:

And that’s even with the dozens of deals halted in the wake of “Liberation Day.”

That’s the first story that shows a desire to “do something” to increase shareholder value as the market touches its all-time high.

The second is about the exact opposite type of corporate maneuver: Spinoffs.

“Coke’s Game” in this piece refers to its many spinoffs over the years to separate from its bottlers.

Pepsi still maintains a lot of its bottling operations. Coke now outsources its bottling and distribution.

Again, this goes beyond just the “Soda Wars.”

Boards across the world are making big moves.

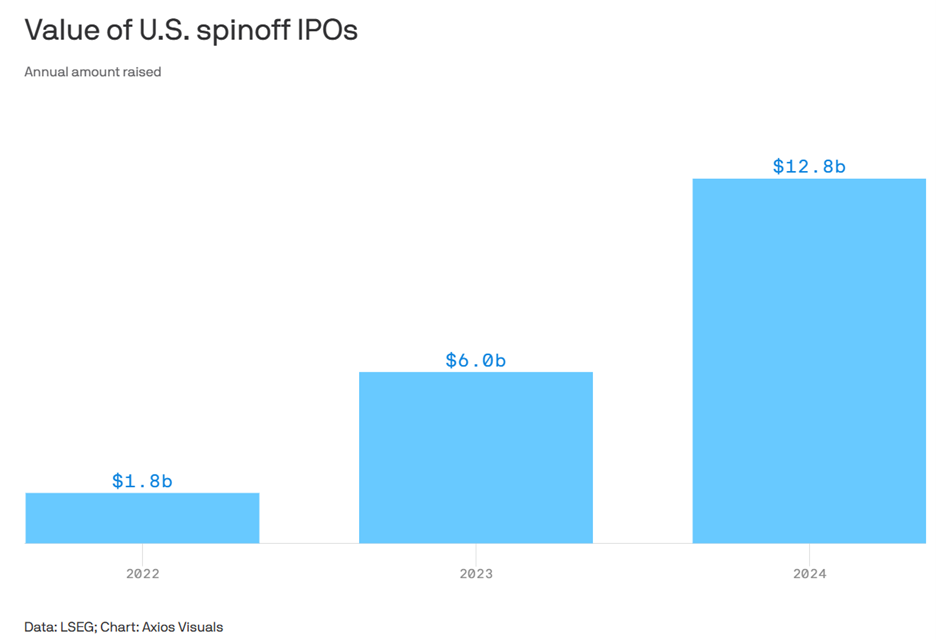

According to Axios, the number of spinoffs around the globe dropped in 2024. But the size of them spiked to $53.9 billion, up 21.3%.

In the U.S., the size of spinoffs jumped even faster:

While the appetite for acquisitions AND spinoffs seems to be growing larger, it’s important to do your due diligence when approaching both.

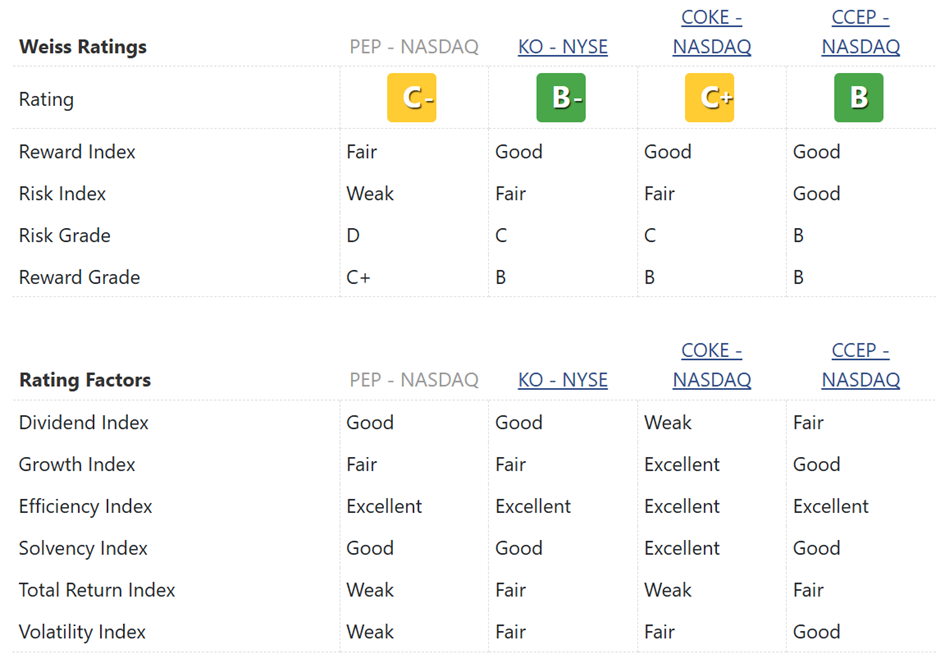

For instance, with Weiss Ratings Plus, you can compare Pepsico (PEP) with Coca-Cola (KO) …

And even a few of its largest bottling partners: Coca-Cola Consolidated (COKE) and Coca-Cola Europacific Partners (CCEP).

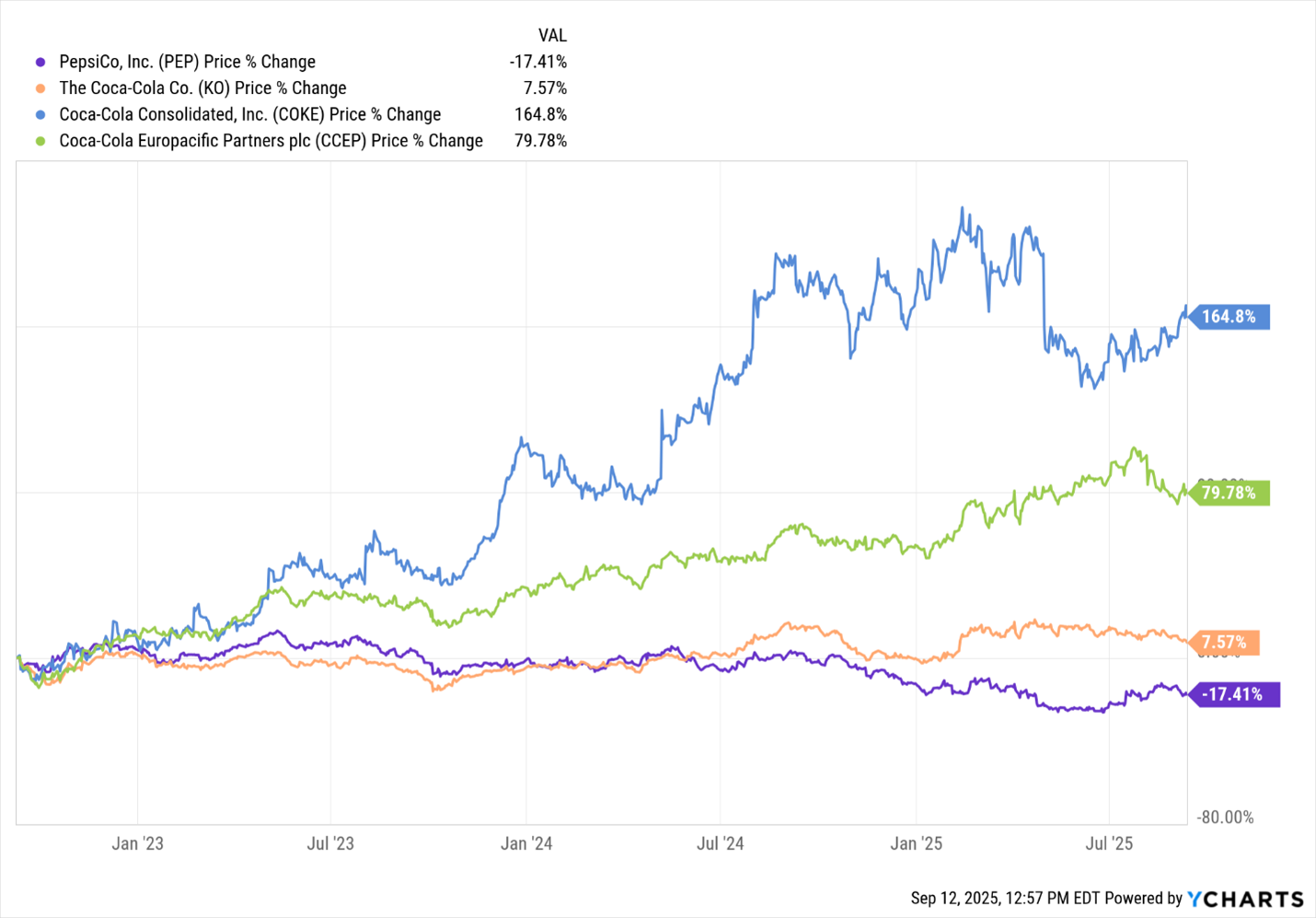

As Wall Street Journal suggested, Pepsi is indeed lagging far behind Coke and its bottlers.

In fact, a quick look at the performance of these four over the past three years tells a distinct picture:

To help you with your own research into the booming M&A and spinoff trends, watch this presentation.

Your editors use Weiss Ratings and the 7+ terabytes of data that power them.

Here’s what they are seeing:

With the Powerball jackpot continuing to climb, Nilus Mattive makes a stunning comparison.

Gold’s ATH Unlocks Another Big Uptrend

Gold is one of those assets mentioned above that’s at its all-time high. Yet, Bob Czeschin shows you how to use it to identify a move for another, seemingly unrelated investment.

What to Do As Gold Breaks Another Record

Sean Brodrick is on the road finding the small junior miners that will lead the pack during gold’s continued bull cycle. Here are his predictions.

You’re the Bank, the Exchange & the Clearinghouse

Crypto is invading TradFi everywhere you look. But Marija Matić prefers another way to play it … one where $20 and $20 million give you the same access.

You Could Have Doubled Your Money on This

Cyber threats are on the rise. And if you followed Michael A. Robinson’s advice a year ago, you’d have doubled your money. Don’t worry if you missed it, though. He says there’s more to come.

That’s it for this week.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily