|

| By Jim Nelson |

We talk a lot about how the Federal Reserve is manipulating both the Treasury bonds and stock markets. But we don’t often acknowledge the absolutely MASSIVE role it has in corporate bonds.

The most successful companies in the world rely on the bond market to leverage their profits. Whether that’s for expansion, new product launches or to enter new markets, public companies need to issue bonds to grow.

High interest rates, like we’ve seen the past two years, were supposed to do serious damage to this element of business. That’s doubly so when it comes to companies with less-than-ideal credit ratings.

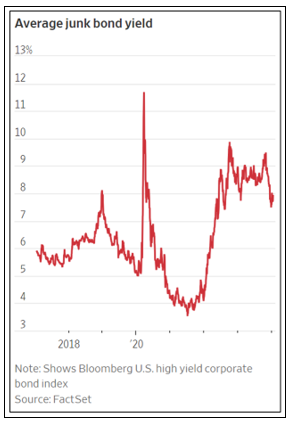

Here’s what the average “junk bond” yield has been over the past few years, courtesy of the Wall Street Journal:

As you can see, only the early pandemic caused rates to spike higher than they’ve been the past two years. However, the duration of higher rates should have forced more problems than they have.

Also, according to The Wall Street Journal, these lower-rated companies have weathered the storm. They are now taking advantage of the rally in bond prices — and drop in yields — to refinance.

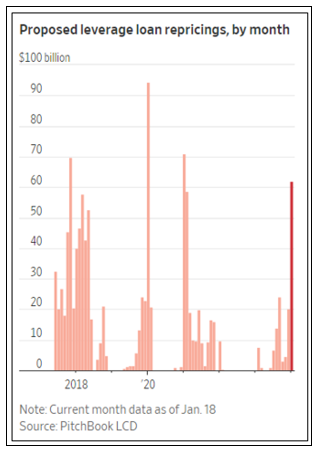

Specifically, variable rate “leverage loans” are being renegotiated in a big wave. These are loans tied to Fed rates. Since the bond markets are already pricing in cuts this year, these companies want to lock in savings now, rather than waiting for those cuts.

More than $60 billion worth of these loans are being refinanced:

And these deals are getting done, essentially saving lower-rated companies from disastrous interest rate expenses.

Many times, companies most affected by a turnaround in debt markets like this are smaller. We’ll see if this leads to a surge in small caps in the coming months. But either way, this does appear — at least for now — to be a very good sign for companies we don’t often discuss in these pages.

It’s something to watch. Of course, our panel of experts have their own markets to watch. And this week, they shared what they are finding …

Biggest ‘Buys’ in the Weiss Stock Ratings

According to our chief ratings guru, Gavin Magor, now is a perfect time to look at the largest “Buy”-rated Weiss Ratings stocks in the wake of last week’s historic news. These companies may be behemoths. But they are also “buys.”

Banks: Which Will Fail First in 2024?

Here’s a topic that’s probably long gone from your memory: banks. Remember that trouble early last year? Well, Gavin is back to explain why the various threats to banks aren’t over. Here’s how to protect yourself.

If you followed Resources Expert Sean Brodrick’s advice, you’d be sitting on 50% gains in less than four months. Fortunately, he now says that there’s more where that came from. So, where are these profits coming from? His favorite metal over the past several months … uranium.

Microsoft Brings Its AI Behemoth to the Masses

Something big is happening at Microsoft (MSFT). Tech guru Jon Markman believes it will have a huge effect on the company’s bottom line. It is bringing many of the breakout features of its Copilot 365 to smaller companies and even individuals. Jon then shares how to play it.

Up 89% in 3 Months! What’s Next …

Our Safe Investing Analyst Nilus Mattive has something that may shock you. He explains why the riskiest individual asset he’s recommended built in MORE safety and has given readers their largest returns ever. Plus, he shares what comes next.

That’s it for this week. Have a great weekend!

Jim Nelson

Managing Editor

Weiss Ratings Daily