|

| By Jim Nelson |

It’s been a busy week at Weiss HQ.

As you can imagine, earnings season gives us millions of new data points that we devour as quickly as we can.

Nvidia’s (NVDA) earnings this week might have been the biggest for the rest of the market. But it wasn’t the only one.

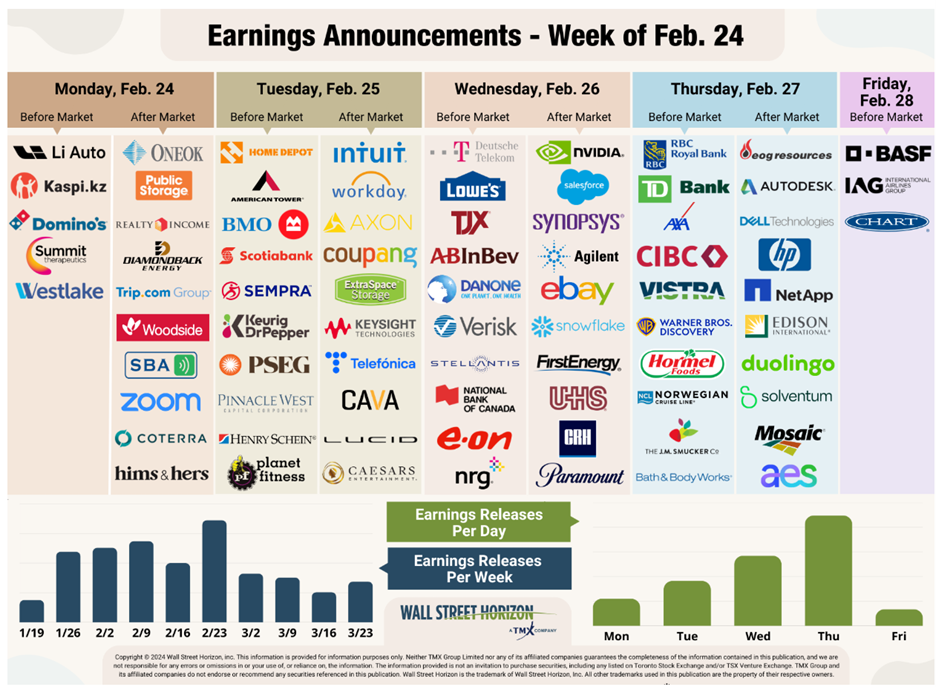

Consider that along with the AI giant, 2,529 other companies reported their earnings … just this week!

We do have some good early data, though, before the season officially wraps up.

In the S&P 500, earnings-per-share growth hit 17%. That’s better than each of the previous three years.

Meanwhile, revenue growth was just above 5%. Meaning cost savings and productivity gains were far more important than booming economic activity during the final quarter of 2024.

Your experts take data like this and turn it into gold. Take Palantir Technologies (PLTR) for instance.

This company happened to be in Michael A. Robinson’s Weiss Technology Portfolio. His readers were up 279% at the start of this week.

But after analyzing all the new data from its earnings, Michael saw the writing on the wall. Shares were going to come down in a hurry.

Sure enough, he told readers to take their 279% gain just BEFORE shares crashed this week. His readers exited at over $100 per share. PLTR ended the week around $84.

For more on what experts like Michael do with all this data, you’ll have to check out what they are writing. Here’s the latest …

Inflation: Chicken or the Egg?

An old market adage tells us that bulls and bears both make money while pigs get slaughtered. It says nothing about chickens, but Nilus Mattive recommends keeping your eggs in as many different baskets as possible right now.

3 Tools to Target 401(k) Funds

Plenty of people have the majority of their retirement savings in 401(k)s, which often don’t give them many investment options. Fortunately, Gavin Magor shows you how Weiss Ratings can help.

How to Play the Bottom in Lithium Prices

One of the least-loved commodities is finding its feet for a big jump higher. Sean Brodrick has the best way to play it.

How to Act on Key Pattern for Quintuple-Digit Gains

Bitcoin has been in trouble all week. Weiss Crypto Managing Editor Beth Canova has the scoop on why this could be the perfect time to get interested in crypto.

AI Upside Without All That DeepSeek Danger

If you watched the post-DeepSeek collapse and this week’s Nvidia earnings and wondered how to seek upside profit potential from AI but steer clear of the danger, Michael A. Robinson has an investment you need to add.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily