|

| By Jim Nelson |

Warren Buffett’s Berkshire Hathaway (BRKB) has been the gold standard for long-term value investors for decades.

So, when it reports its quarterly 13F regulatory filing — which details what its current investment stake is in each stock — people pay attention.

Here, we can see what Buffett is buying and selling in quarterly increments. And for the past eight quarters, it’s been lopsided.

Lately, he’s a seller.

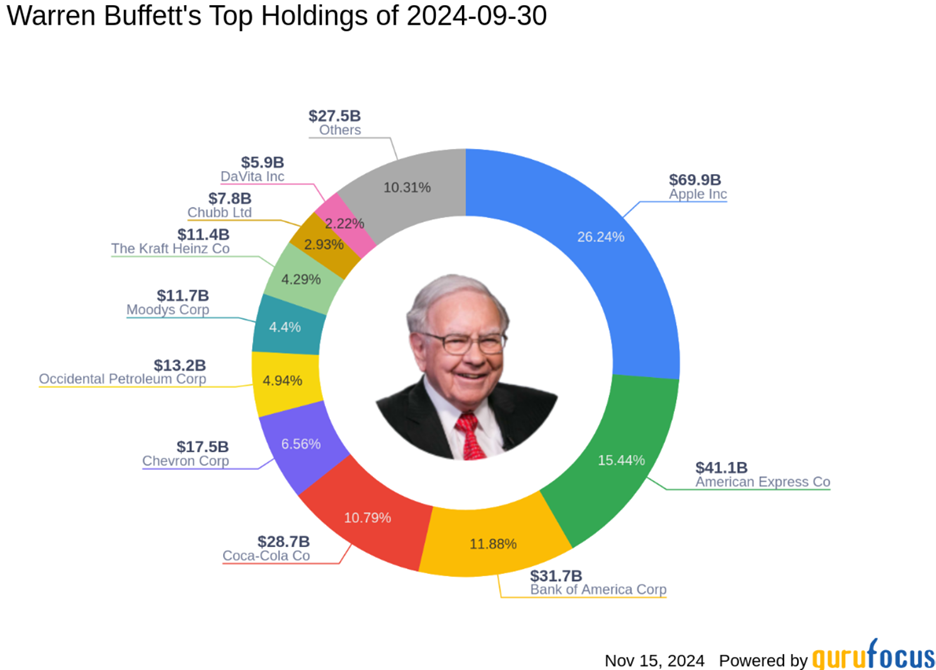

The most recent filing shows that BRKB sold 25% of its massive stake in Apple (AAPL) and 23% of its long-held Bank of America (BAC) stock.

In total, Buffett’s investment company sold $34.6 billion worth of shares. And it bought just $1.5 billion in small (for him) increments of Domino’s Pizza (DPZ) and Pool (POOL).

Those moves bring Berkshire’s total cash position to $325 billion.

That’s enough money to outright buy a 100% stake in all but 25 of the thousands of publicly traded companies in the market right now.

Back in May at the company’s annual meeting, Buffet was asked why he was hoarding cash. He said:

"I don't think anybody sitting at this table has any idea of how to use it effectively, and therefore we don't use it. We only swing at pitches we like."

And despite the S&P 500 rallying 23% so far this year, he’s not alone.

Your editors are looking far and wide for ideas outside the mainstream.

Take your supercycles expert Sean Brodrick, for example. This week, he turned his attention to a market you probably haven’t heard him discuss much — cryptocurrencies … specifically, Bitcoin.

He found three driving forces that should carry the top crypto even higher in 2025 than it is right now, which is already at an all-time high.

He writes: “In 2025, I expect these Bitcoin dominoes to fall — the government, corporations and big banks. And that will kick Bitcoin’s climb into overdrive.”

I urge you to check out his analysis here.

Then there’s your Senior Investment Writer Karen Riccio. She’s not saying it’s time to channel Buffett and exit stocks. But she suggests you build in some much-needed protection now:

“We will have a leadership change in the White House and the Senate.

“We have ongoing wars in the Middle East and Europe … with threats of unrest in Asia.

“Interest-rate policy seems set for right now. But exactly how many cuts, and what size, is still up in the air.

“There’s also no love between the incoming U.S. president and the head of the Federal Reserve.

“Finally, tariffs, tax policy changes and more are on deck. We could start to see those decisions, and their effects, in the next few months.”

Her recommendation: Buy some hedge protection through inverse ETFs.

That’s not to say all stocks are at risk. Not even Warren Buffett is saying that.

In fact, your other editors have a few lined up for you to consider buying today …

Find Winners in a Mammoth Market

Gavin Magor looks at our highest-rated stocks that have been on fire over the past 90 days. And there’s never a bad time to turn to this list. He even found one he really likes that you might consider adding to your portfolio.

Trump, Musk, Thiel & What’s Next for Stock Market

Dawn Pennington is watching the post-election chaos in the markets with eagle eyes. And she has several companies that are booming because of who they are associated with. She also has another takeaway from this post-election wave.

How to Profit from Our 147-Zettabyte World

Finally, as always, Michael Robinson has his eye on the tech world. He has one company that is absolutely crucial to the unfathomable amount of data we as a society are creating.

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily