|

| By Jordan Chussler |

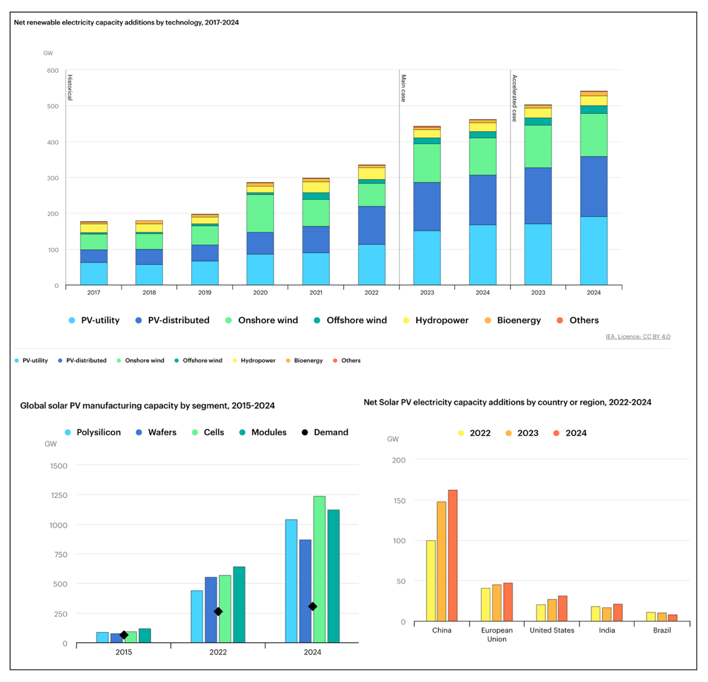

This year is renewable energy’s time to shine.

For the first time ever, investments in green energy will surpass investments in fossil fuels.

According to the International Energy Agency, “Renewable power [is] on course to shatter more records as countries around the world speed up deployment.”

The agency went further, stating that in 2023, “For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one.”

The forecast is for $2.8 trillion to be invested in energy worldwide this year. Of that:

• More than $1.7 trillion is expected to go into renewables and nuclear power.

• The rest will go to oil, gas and coal.

Click here to see full-sized image.

As Senior Analyst Sean Brodrick explained in his column this week, that will have a particularly outsized impact on one renewable energy source.

Power Up for This Investing Boom

This year will be landmark in the world’s energy landscape: 2023 is the first year more money will be invested in green energy than in fossil fuels. Sean explains how much that investment will be, why it’s happening and what you can do to take advantage as an investor.

Learn Our Strategies from the Sources Themselves

In a year that’s proven unpredictable for the markets, the one constant has been how Weiss analysts and editors deploy safety-oriented strategies. This year, you can meet them in person to learn more about their methodology and tailored picks.

Even Michael Scott Can’t Revive ‘The Office’

Office buildings have one foot in the grave, and that’s going to have an enormous impact on the banks that specialize in commercial real estate lending. Director of Research and Ratings Gavin Magor explains how those institutions might be the next to fall in the ongoing banking crisis.

Why You Should Buy This AI Network Juggernaut

When it comes to artificial intelligence, the Big Tech names are garnering a lot of attention. But according to Pulitzer Prize winner Jon Markman, it’s the ancillary companies that are going to provide massive upside, including one firm that makes the hardware and software infrastructure that’s critical to AI.

The Skilled Workers Gap Could Close with This New Trend

Decades of pushing academics has created a huge skill gap in America. But a trend in vocational careers might close it. There have been 1 million fewer student enrollments in college since the pandemic began. Senior Investment Writer Karen Riccio details this renewed push for vocational skills and how one company could benefit.

Spring Cleaning with Weiss Ratings

As helpful as our ratings are for portfolio additions (four stocks were just upgraded to “A” ratings), they’re equally helpful in figuring out what to avoid. This week, Gavin explains how 302 total stocks have been downgraded to “E” territory and should be approached with extreme caution.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily