|

| By Jim Nelson |

If you were to ask a handful of active investors how this week has gone in the market, you’d probably get wildly different responses.

That’s because it’s all about perspective …

Tech stock investors — or at least those following the biggest names in the market, like Nvidia (NVDA) — would say it was a great one. This week broke last month’s downward trend.

But there are two sides to every story … and always another perspective to consider.

Energy stock investors had a very different week.

After another pretty solid month — as part of a really solid summer — energy stocks had a pretty bad week.

This is made especially clear by looking at each sector’s 1-month and 5-day performances.

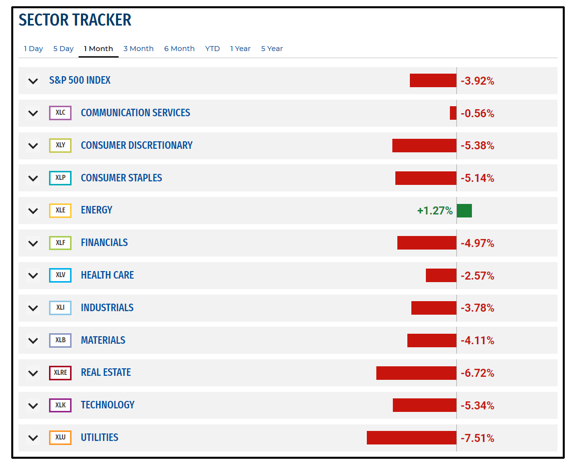

First, the 1-month:

As you can see, the past month hasn’t been kind to most sectors, tech stocks included. The sole group ahead over the last 30 days is energy, represented by the Energy Select Sector SPDR Fund (XLE).

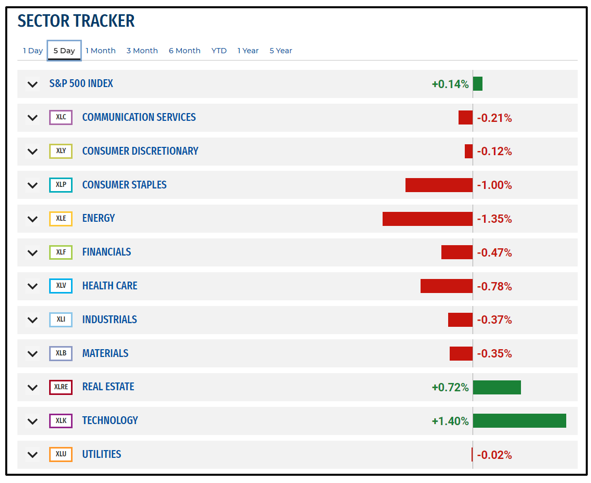

But look at what happened in the last five days …

Energy crashed hard, while tech stocks — represented here by the Technology Select Sector SPDR Fund (XLK) — appear to have regained the traction they had in the first half of the year.

Is this another inflection point for the market? Is the summertime energy boom over? Are tech stocks back on the menu?

We’ll see. And, of course, our experts are here to chart this course. Here’s what they had to say this week …

With AI so much in the news lately, Weiss Founder Dr. Martin Weiss breaks down just how long we’ve been ahead of the game … identifying Nvidia as a “Buy” as far back as 2011. He also introduces where the next AI boom will come from.

Profit off Uncle Sam’s Strength

The U.S. dollar is as strong as it’s been in the last 20 years, despite — and partly because of — the recent Fitch credit downgrade. Weiss Ratings Director Gavin Magor explains how to best play this wild turn of events.

1 Chart to Power Up Your Profits

While energy stocks in general have had a strong summer, Natural Resources Analyst Sean Brodrick points out that it’s not oil or gas stocks leading the way. In fact, he shares a chart that shows another energy source is the place to be. He identifies it, as well as a great way to play it.

Profit from Disney’s Latest Mistake

Disney (DIS) has been in the news a lot lately, for several reasons. However, Pulitzer Prize winning writer, Jon D. Markman, points to one story that will not have a fairytale ending for the company. There is, according to Jon, another company worth buying instead.

Don’t Miss This AI Profit Opportunity

Gavin Magor also shares just how big the AI industry is expected to be (it’s even bigger than you might think). Of course, being the Weiss Ratings expert he is, Gavin dug deep into the Weiss ratings stock screener to find how to play this ongoing AI boom. He shares his findings right here for you.

That’s all for this week. Have a great weekend!

Until next time,

Jim Nelson

Managing Editor

Weiss Ratings Daily