|

| By Jim Nelson |

Stocks celebrated their second-best day of the year Wednesday. Yet, just one day later, they limped away from their worst.

As the calendar flipped to the new month, investors woke up to a long-forgotten indicator flashing red again.

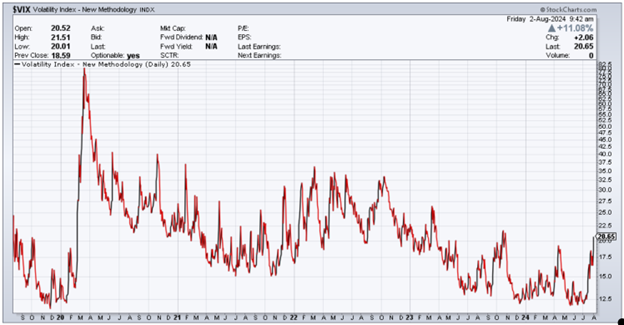

The CBOE Volatility Index, or VIX, finally surpassed the 20-point mark for the first time since October 2023.

And yesterday, it surged another 10 points to just shy of 30.

That’s right … volatility is back.

The VIX is a measure of market volatility … as the name implies.

It uses S&P 500 index options to predict how wildly the biggest stocks in the market will swing in price over the next 30 days.

This is great news for day traders — who aim to time those giant swings — and option sellers, like those who are part of our Weekend Windfalls family, where we haven’t seen a losing trade since May 2022 — who profit from higher option premiums.

But it can be a pain for most other investors. Especially if you’re doing this on your own.

For instance, if you use stop losses and trailing stops to prevent any one position crashing your whole portfolio, increased volatility can trigger those stops more easily.

Your Tech & Biotech Investing Strategist Michael A. Robinson has been using stops in his publications to protect big gains. His subscribers just grabbed a 2,000%+ gain this week this way.

So, if you want to start using stops the right way, Michael wrote about this strategy earlier this month. You can read that here.

Volatility can also mess with hedging strategies. If you use leveraged ETFs or buy protective puts to offset a potential market crash, higher volatility makes those strategies more expensive.

For leveraged ETFs, you can also experience even wilder price movements since they work by doubling or even tripling the price movements of their underlying index.

When the VIX hits 20, however, it’s far from the end of the world.

If we take a longer look at the VIX, we see it can go much higher:

But this recent spike — caused mostly from the uncertainty over the future of the tech-heavy composition of the S&P 500 right now — does point to one thing … it’s certainly “silly season” in the market at the moment.

Director of Research & Ratings Gavin Magor has more on what that means … and how to find sanity in it … here.

For how the rest of your experts are playing this increasingly volatile market, read on …

4 Stocks to Buy After CrowdStrike Disaster

If you happened to be traveling or trying to do your banking in the middle of last month, you might have had cause to curse the name “CrowdStrike.”

Fortunately, the “largest IT outage in history” wasn’t a cyberattack. But it does offer insight into how companies are going to start preparing for one.

Senior Investment Writer Karen Riccio has four stocks to buy ahead of time.

Supercycle expert Sean Brodrick is always discovering and pinpointing shifts in the market. When a new cycle begins, he’s who you want to listen to.

And this week, that happened.

He also has the perfect way to play this new cycle to get the most upside from a major market shift.

From Excise Taxes to Excessive Taxes

“Whatever happened to the spirit of Colonial America?” That’s the central question Safe Money Analyst Nilus Mattive is asking this week.

We used to throw tea in Boston Harbor over a simple tax. Now, we vote for them. He assures us that this isn’t a political issue.

He also has three remedies to legally cut your personal tax burden and to regain the colonial spirit.

Earn Real Profits from Synthetic Data

Always out in front of huge developing tech stories, Michael highlights the fast-growing market in data. Not just any data … synthetic data.

Companies like Nvidia and Amazon are making big splashes in this field. But he found a company that just partnered with Google to revolutionize health care with it.

Have a great weekend!

Jim Nelson,

Managing Editor, Weiss Ratings Daily