|

| By Jim Nelson |

All eyes remain on the possibility that we are in an AI-fueled bubble …

One that could pop at any time and send stocks into a freefall.

Two weeks ago, Jeff Bezos told an audience:

"When people get very excited, as they are today, about artificial intelligence, for example … every experiment gets funded, every company gets funded. The good ideas and the bad ideas.

“And investors have a hard time in the middle of this excitement, distinguishing between the good ideas and bad ideas.

“So that's also probably happening today. But it doesn't mean that anything that is happening isn't real."

Your safe money expert, Nilus Mattive, agrees. He is calling for a “major implosion.”

In fact, Nilus just wrote that “The Greater Fool Pool Will Dry Up.”

Crypto and AI expert Jurica Dujmovic claims “The AI Bubble Is Already Popping.”

These aren’t the only ones keeping a close eye on the bubble.

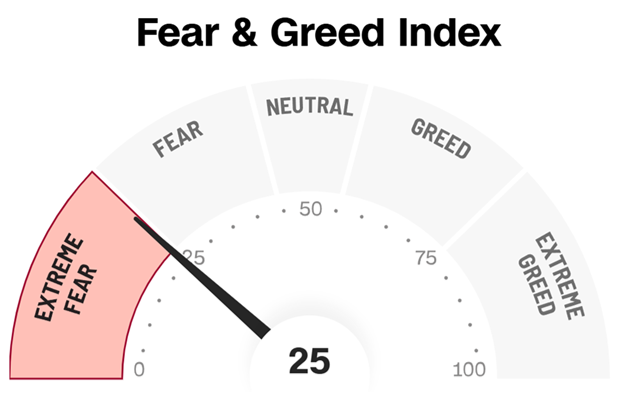

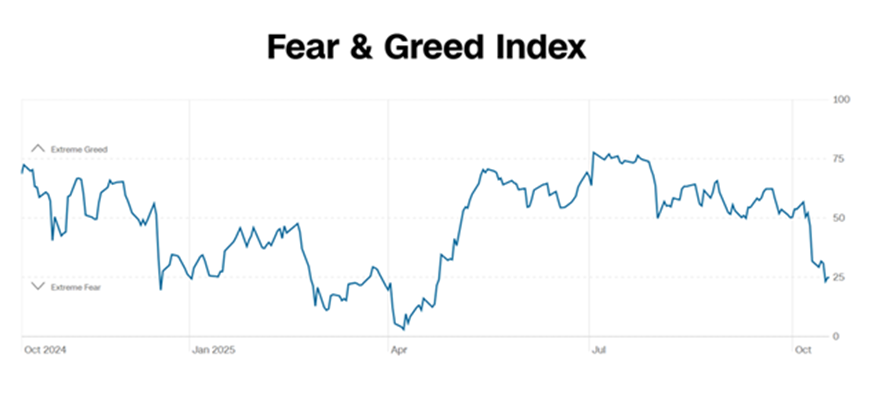

Fear is back:

As you can see, CNN’s Fear & Greed Index just tipped into “Extreme Fear” territory briefly yesterday.

It’s the first time the gauge showed this much market worry since April, shortly after stocks crashed on Liberation Day tariffs.

Meanwhile, gold — the oldest hedge against market risks — sliced through $4,000 like a hot knife through butter.

Hopefully, you’ve been following Sean Brodrick’s advice from the beginning.

If not, you can still use yesterday’s sharp pullback to get in on the precious metal.

And if you are willing to take on a little risk, Sean has “3 More Stocks for a Full Throttle Gold Rush.”

Of course, the market’s newfound fear and its rush into gold aren’t the only hot topics your experts are digging into.

Juan Villaverde just unveiled his Crypto Timing Model 2.0. And it showed him that "A Second Divergence Separates China & the Fed."

This, like the one he showed you two weeks ago, points to big things happening in the crypto space.

Finally, your tech specialist, Michael A. Robinson, still sees profits to be made, even if the largest tech stocks have to give them directly to shareholders.

He even shows you "How to Play The $1.1T Buyback Wave."

That’s it for this week.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily