|

| By Jim Nelson |

There’s a giant gap in today’s market.

If someone from the early 20th century traveled to 2025 and somehow still had the desire to invest, they’d be shocked at what they found.

No, I’m not just talking about AI companies making up 40% of the stock market. Though, that IS a part of it.

The ability to invest in just about any stock and get paid to own it is nearly gone.

I’m talking about dividends.

A century ago, companies of all sorts paid a dividend to their shareholders.

International Harvester, the backbone of agricultural mechanization, paid a dividend until the early 1980s.

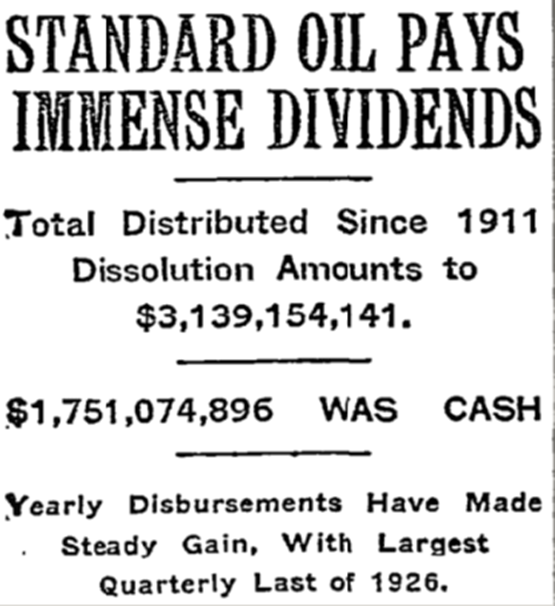

Standard Oil was known for its dividends:

Even Carnegie Steel — owned by tycoon Andrew Carnegie, who famously fought with his board to reinvest all the company’s earnings instead — paid dividends.

So, why does a simple search for high dividend paying stocks today look like this:

Those are all the largest payers with a “Buy” rating in the entire 12,000-plus Weiss system.

Look at the right-hand column. You get one energy company, one utility and a handful of financial firms.

You don’t see the likes of Apple, Microsoft or even Berkshire Hathaway.

And you certainly don’t see gold stocks, crypto funds or private equity groups.

But there IS a way to collect income from those types of places … including major tech stocks.

Many of your editors have already hinted at it this week.

Nilus Mattive wrote about the problem with how most of us think about retirement these days.

One of his conclusions was that you need to diversify your portfolio. But how can you do that with the above results?

Gavin Magor pointed out “Your Newest ‘A’-Rated Stock.”

But unlike last year’s, it isn’t a great dividend payer … despite being in the financial sector.

Sean Brodrick wrote about how the recent pullback in gold is nothing but a blip in gold’s massive rally.

But we know that gold is not known for helping you boost your income.

Marija Matić unveiled a way to collect rewards from crypto for the first time.

But it, too, is normally a desert for income seekers.

Finally, Michael A. Robinson, your tech expert is looking at a new cross-Atlantic partnership to lock in a profit opportunity.

Here, too, no income to be found.

Fortunately, several of these experts are teaming up on Tuesday, Oct. 28, at 2 p.m. Eastern to share a way to have all these assets AND collect income at the same time.

You can join them — along with Dr. Martin Weiss and startup specialist Chris Graebe — to take the “All-In Retirement Income Challenge.”

That’s it for this week.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily