|

| By Jim Nelson |

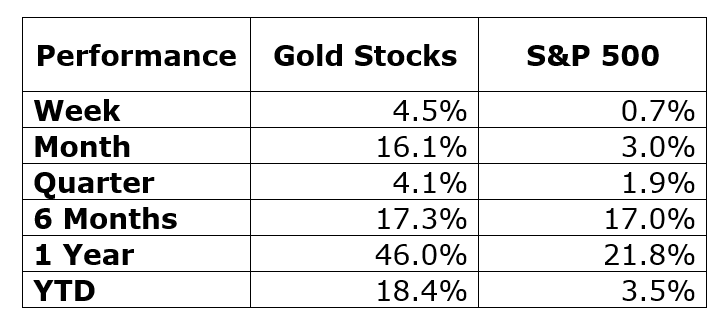

If you had to own either an S&P 500 index fund or a broad selection of gold-related stocks over the past year, which do you think would have done better?

How about the past quarter? Month? Week?

In every instance, gold stocks would have been the better bet.

In fact, even with all the record highs of the broad market index ... and the boost from all the AI giants it contains leading the way ... gold still did better.

That’s true of both gold itself and miners, royalty companies and dealers.

Not only have gold stocks beaten the high-flying S&P over every imaginable period in the past year …

But it almost seems like it’s harder to pick a bad gold company than a good one to invest in!

Now, I don’t recommend throwing a dart and buying just any gold stock.

But it’s hard to ignore the fact that, year to date, 91.5% of all gold stocks are showing gains.

As for the S&P 500, only 65.6% of them are up.

Two-thirds of stocks in the S&P 500 doing well so far in 2025 is nothing to sniff at.

But gold’s nine out of 10 is hard to beat.

And, of course, an average gain of 18.4% compared to 3.5% is incredible.

Your experts agree …

Sean Brodrick, our gold guru, wrote this on Wednesday:

“I’ve pounded the table about gold for quite some time. I sent my subscribers gold reports, the Resource Trader portfolio is bristling with great miners and I plan to give them more. Why? Because this gold rally is the real deal.

“So how do I know?

“Time is short, and I’ve previously covered some major forces driving gold, with examples here and here.”

Sean went on to give us three new reasons and a new way to play this rally. Check them out here.

As I mentioned earlier, you don’t want to just go out and buy any gold stock. If Sean gives you an idea, however, that’s as good as (forgive me) gold.

Another way to find solid (again, forgive me) gold stocks is right here within our Weiss Ratings.

That’s why we forwarded you our list of top-rated gold stocks for 2025. As our Research & Ratings Director Gavin Magor said:

“Gold offers much more than a way to capitalize on outsized gains. It gives you an added layer of diversification that doesn’t necessarily turn down when stocks remember that their job is to go up.

“That should be especially true in the new year, whose opportunities and challenges have yet to reveal themselves.

“Just like stocks and bonds, many variables impact gold’s performance.

“In 2024, buying by central banks and elevated retail interest especially from China and India drove up demand and, therefore, the price of gold. Asia consistently makes up more than 60% of gold’s annual demand.

“What’s not so great are the negative factors behind record-setting gold prices. Things like continued high inflation, the high cost of goods and services and currency depreciation.

“All those factors make gold, I believe, more valuable to you today as a hedge in your portfolio.”

He even gave us NINE ways to play the metal.

In light of all this, we asked our publisher to do something special for you. He agreed.

So, it’s our pleasure to give you our 1,000x Gold Investing Blueprint.

What’s more, you can claim a Weiss-exclusive 2-gram gold bar. This is only available until Monday.

Of course, gold isn’t the only gift worth giving … or receiving. Nilus Mattive has a slew of “freebies” if you know how to use credit cards the “right way.”

Gavin also took us on a deep dive of Nvidia (NVDA), its ratings and why it “checks all the boxes.”

Finally, our tech specialist, Michael A. Robinson, has the scoop on the reason you can’t put down your phone … and the one company behind it.

That’s all for this week. Again, I urge you to check out this limited opportunity to put gold in your pocket.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily