With Rate Hikes Likely Easing Up, Here Are the Latest Opportunities

|

| By Mahdis Marzooghian |

It was all thanks to tech stocks for leading the major averages higher on Thursday. Meanwhile, investors are looking for clues regarding the path of interest rates in the latest labor market data.

In fact, it does seem like the labor market is finally getting back to normal, which further solidifies the fact that the Fed’s crusade of anti-inflation interest rate hikes did have the desired impact that Powell & Co. have been looking for.

Indeed, a soft landing is now a more likely scenario for the economy, with traders anxiously betting on a Fed policy shift to cut rates.

However, the crucial monthly U.S. jobs report that came out yesterday was the last real economic test before the Fed's last meeting of the year this upcoming Tuesday and Wednesday. Unemployment declined to 3.7%.

Investors seemed mixed following the report. We’ll just have to wait and see how the Fed reacts to the data.

But back to the market — the Dow Jones Industrial Average lagged the other major averages, rising about 0.2% this week. On the other hand, the S&P 500 popped 0.8%, and the tech-heavy Nasdaq rose nearly 1.4%, signaling a rebound for tech stocks.

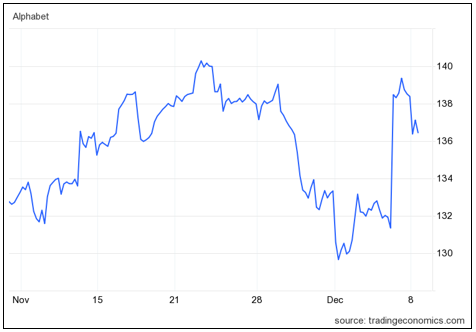

Alphabet (GOOGL) led the gains in tech stocks, with shares surging more than 5% after the company launched new AI initiatives.

And if you’ve been following along here at Weiss Ratings, then you know how excited our experts are about the sizzling-hot trend of artificial intelligence, among others. In fact, they’ve got a fresh batch of research and data that you don’t want to miss …

Power Up with Newly Upgraded Weiss Ratings Stocks

Our Director of Research & Ratings Gavin Magor has not one but two newly upgraded “A”-rated stocks that need your attention, plus some features you may not know about.

Beware: Holiday Spending ‘Home Run’ May Be Precursor to Strike 3

This may come as a surprise to many, but the $38 billion consumers spent between Thanksgiving and Cyber Monday isn’t the home run analysts want you to believe it is. Gavin is here to tell you why.

3 Major Warnings About Gold Miners

Gold just hit a new record high. Our Natural Resources Analyst Sean Brodrick gives us three reasons why some gold miners will still be losers. Plus, he gives insight on the kind of miners savvy investors should buy.

We’ve Reached the Plateau of Productivity

A Jefferies analyst recently made a fool of himself on CNBC while talking about the latest blowout report from this popular CRM platform stock. As always, Megatrends Analyst Jon Markman has the perfect opportunity to play this overlooked digital transformation.

The Challenges Facing the ‘Digital Dollar’

We don’t often focus on cryptocurrencies here, but with many of these digital tokens’ prices doubling already this year, it’s simply a sector you can no longer ignore. That’s why we’ve asked crypto expert Jurica Dujmovic to catch us up on CBDCs and what they mean for cryptos going into 2024.

Until next time,

Mahdis Marzooghian

Managing Editor

Weiss Ratings Daily