Commodities are in rally mode. But is this current run done?

Not according to JPMorgan Chase (JPM). The Wall Street bank says that there could be another 40% UPSIDE in commodities.

I don’t think that target is wrong, though it may be too low. And that means there’s tremendous profit potential for investors right now.

Nikolaos Panigirtzoglou (I dare you to say his last name right on the first try), a strategist at JPM, says if investors boost their allocation to raw materials at a time of rising inflation, that’s where you could get 40% upside.

“It is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous highs.”

All else being equal, that “would imply another 30% to 40% upside for commodities from here.”

Some commodities will outperform others.

For example, Goldman Sachs (GS) is ringing the alarm bells about copper, saying the industrial metal is building toward a price breakout and there is a “risk of extreme scarcity episode by the end of the year.”

Wow!

But allocation is only one reason why commodities can go higher. Let me quickly give you three others.

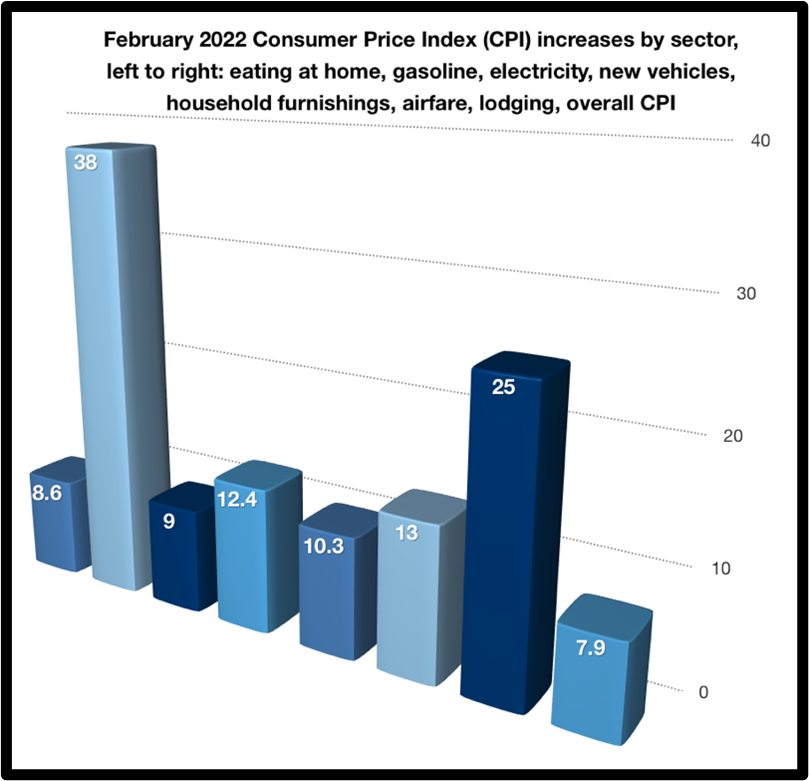

1. Inflation remains red-hot. JP Morgan Chase cited inflation as fuel for commodity price gains, and boy, is that ringing true.

Inflation is now running at 7.9%. That’s a 40-year high. Energy prices are fueling the big move, but the price of just about everything is going up.

We’ll get fresh inflation data on April 12. I’d expect some kind of pullback — nothing goes in a straight line. But longer term, I’d expect inflation to zigzag higher.

And the longer cost inputs stay high, the more pressure on producers of all kinds of commodities to raise prices.

2. Russia’s war in Ukraine drags on. In fact, experts warn that Russia is about to launch a new offensive. This matters because both Russia and Ukraine are big commodity exporters.

I gave you lists of commodities that could be affected by the war here, here and here. They include oil and gas, platinum, palladium, nickel, steel, aluminum, wheat, corn and more.

The longer the war goes on, the more global supply of these commodities will be impacted. Russia shows no sign of quitting. And mention “surrender” to the Ukrainians and they’ll spit in your eye.

Even after the war, we can expect sanctions to stay in place until Russia’s atrocities are dealt with.

3. European investors are fleeing stocks. On March 29, I told you how European investors are selling their stocks on a massive scale. The reason is simple and twofold.

There’s the potential for much worse news in Ukraine … and energy prices are even worse in Europe comparatively, which is dragging down economic activity.

U.S. investors shouldn’t complain too much. As Europeans sell their own stocks, they’ve moved a chunk of money into U.S. markets. This is propping up the major U.S. stock indices.

Well, the news on April 7 is that the European sell-off is continuing. In all of March, European equity exchange-traded products (ETPs) suffered outflows of $6.5 billion!

Some of that went to U.S. stocks. But a bunch of money is going into commodities. BlackRock reports that commodities as a European asset class rose to its highest level in two years, with $12.8 billion of inflows.

The longer the trouble in Ukraine drags on, the longer Europeans are likely to keep allocating toward hard assets.

They have other reasons to do so, sure. Starting with rip-roaring inflation. Again, that’s not going away anytime soon.

So, how can investors consider reacting?

For starters, look at insane inflation, mind-boggling government debt and the war in Ukraine. These are all tied to irreversible cycles converging at this very moment.

That’s why I recently had an emergency Zoom call with Dr. Martin Weiss. In it, we cover details of ways your family can protect and grow its wealth. I take this deeply to heart. If you’d like to learn more, check it out now while it’s still available.

Other ideas?

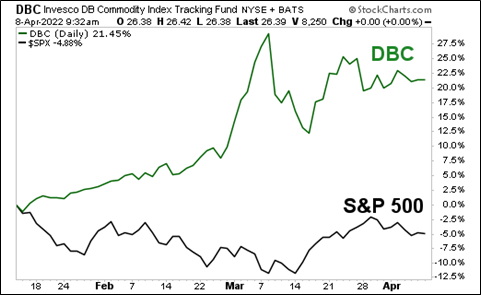

In my Jan. 13 column, I recommended the Invesco DB Commodity Index Tracking Fund (DBC).

This fund invests in futures contracts on 14 commodities, including gold, copper, corn, soybeans, gasoline and more. DBC has a total expense ratio of 0.88%.

Now, what if you’d listened to me on Jan. 13 and bought the DBC? Here’s a performance chart showing the DBC and the S&P 500 since then:

You can see that since I talked about it, the DBC is up 21.45%. Compare that with the 4.88% loss in the S&P 500 at the same time. I sure hope you bought it, or something similar.

So, what would another 40% upside look like?

A 40% rally would bring the DBC to about $37. That’s a nice move, but well below the high of $44.48 it hit back in 2008 during the last commodity bull cycle.

In fact, adjusting for inflation, the DBC would have to go to $58.61 to hit its old inflation-adjusted high.

That’s a move of 122% from recent prices!

To be sure, we don’t know where this commodity bull will end. And it won’t go in a straight line. But pullbacks can be bought. And you probably should get on board this commodity train.

As always, remember to do your own due diligence before entering any trade.

All the best,

Sean