|

| By Beth Canova |

Crypto is an emerging market.

But the Wild West days — where memes and hype held ultimate sway and 60% swings were considered normal — may be behind us.

And that’s not just because of the maturity that comes with age.

But rather because there’s a new investor group on the blockchain. And it’s one that craves order and consistency: TradFi institutions.

Their investment dollars won’t flow into overhyped speculative plays. Instead, institutions are targeting quality projects that promise real utility.

In his recent update, Mark Gough breaks down the 5 Key Turning Points That Suggest This Sentiment Shift. And he shows you which projects are gaining the most institutional attention.

Attention that should hit a strong catalyst come the fall. According to Marija Matic, the near-term price action may be sluggish. But Bitcoin’s August Chill Might Spark a Red-Hot Q4.

Indeed, late September through November has historically seen the most bullish moments in crypto. Institutional interest could turn up the heat even more this go-around.

This sentiment shift from TradFi is so strong, even the wildest sectors have started to fall in line.

Like NFTs.

Non-fungible tokens were the poster children of the 2020-2021 crypto craze. Celebrities and retail investors alike all jumped in, hoping their cartoon critter would grow into a life-changing investment.

Today, NFTs Gain New Life and New Maturity to Appeal to Institutions.

Just like in the broader market, NFT projects have shifted to focus more on utility and practical applications to entice those sweet institutional dollars to flow their way.

And according to tech expert Jurica Dujmovic, this change has finally revealed the true strength of this exciting crypto sector.

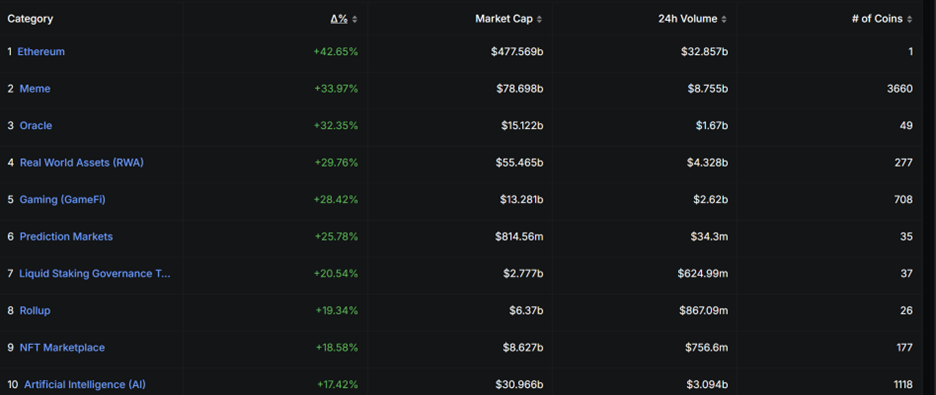

The NFT Marketplace has seen an 18.5% increase over the last 30 days, putting it in the top 10 best sector performers according to data from DeFiLlama.

And other sectors that intersect with NFTs — such as real-world assets and GameFi — have seen even stronger performances in that time.

Another strong narrative has been crypto AI, which rose 17.4% in the past month.

Unlike traditional AI — which is almost exclusively the playground of large corporations who can afford to train and run the complex models — crypto AI is decentralized.

It combines the best of blockchain technology and AI opportunity. Which is why in my update this week, I broke down 3 Decentralized AI Opportunities That Are Not to Be Missed.

One note, however, comes from Jurica. He warns that AI May Be a Double-Edged Sword for Crypto.

That’s because rising in popularity in the AI narrative are AI agents: autonomous bots build on existing AI models that can help automate crypto investing.

That sounds promising! But Jurica cautions investors to be mindful of howthey use these AI agents. And he warns us to be mindful of how centralized they can be and the potential risks they carry.

But that’s all for this week. Be sure to look to your inbox tomorrow afternoon for your next Weiss Crypto Daily update.

Best,

Beth Canova

Crypto Managing Editor