|

| By Jordan Chussler |

The great American shopping spree may finally be coming to an end.

On Wednesday, the U.S. Department of Commerce announced the most recent retail sales figures.

Consumer spending declined 0.4% in February compared to January, when it rose a staggering 3.2% from December 2022.

According to the data, in February:

- Americans spent about 2% less on cars and car parts.

- They spent 2.2% less at restaurants and bars.

- And spending at department stores dipped 4%.

But do you know where people didn’t slow down their spending? The supermarket.

In fact, people spent 0.6% more at grocery stores.

Wants Vs. Needs

This shouldn’t be a surprise, though, as consumer staples are inelastic in demand and entail what people need, not what they want.

In an ongoing inflationary environment that has seen a record eight consecutive interest rate hikes by the Federal Reserve, discretionary spending was eventually going to give way.

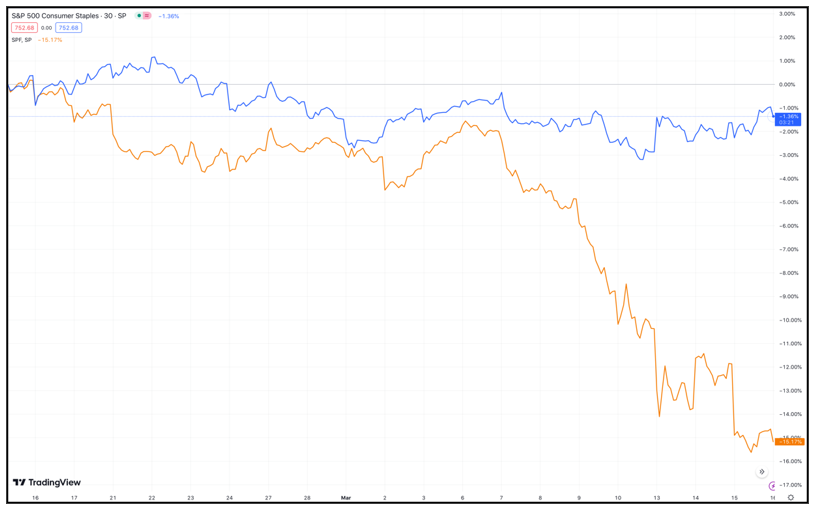

It’s notable that over the past month, all 11 of the S&P 500 sectors are in the red. However, it’s consumer staples that’s slipped the least, with a -1.36% loss compared to the financials sector’s -15.17% slide.

Click here to see full-sized image.

Unsurprisingly, this has been reflected in the Weiss ratings.

Of the 16 highest-rated companies, six are leveraged to food, including grocery store chains like “B+”-rated Ingles Market (IMKTA) with its 0.74% dividend yield and Weis Markets (WMK) with its 1.66% yield, and “A-”-rated pizza chain owner and operator Pizza Pizza Royalty (PZA.TO) and its 4.24% yield.

Depending on where you live, those companies may not be household names. However, these others undoubtedly are:

- General Mills (GIS), 2.69% dividend yield, rated “B+”

- The Hershey Company (HSY), 1.7% dividend yield, rated “B+”

- The J. M. Smucker Company (SJM), 2.67% dividend yield, rated “B+”

Like I wrote last week in my column, “Stop Sleeping on Hospital Stocks,” there are certain things people will always need: Medicine. Electricity. Food.

As an investor, neglecting to represent their corresponding sectors — healthcare, utilities and consumer staples — in your portfolio is dismissive of safety-rated profit potential.

To discover more about where to find ongoing strength in the markets, here are this week’s top stories from our team of Weiss Ratings analysts and editors.

SVB’s Collapse Should Send Gold Higher

After 2008’s Financial Crisis, Congress imposed rules on the financial system through the Dodd-Frank Act that laid out restrictions on bank lending to prevent a repeat of the crisis. In 2018, the Trump administration rolled back those regulations. As banks are once again failing, Senior Analyst Sean Brodrick says precious metals are poised to profit.

VIDEO: Market Minute with Kenny Polcari

In this installment of his weekly look-ahead series, Financial News Anchor Kenny Polcari reports on the SVB collapse and this week’s macroeconomic data, including the Consumer Price Index, the Producer Price Index and consumer spending figures.

Short This Tech Company Amid SVB Failure

SVB’s failure was the second-biggest bank failure in U.S. history. Pulitzer Prize winner Jon Markman explains how its other companies — like this one — that will suffer next.

A New Arms Race Getting Underway

Between America’s ever-growing defense spending, escalating tensions with China and military aid to Ukraine, Analyst Nilus Mattive discusses how investors can set themselves up to profit from ongoing geopolitical tension.

How to Navigate the Market’s Liquidity Problem

History has shown whenever there is a big drop in liquidity, there is almost always corresponding downside volatility. Senior Editor Tony Sagami reports on how investors can safeguard their portfolios.

ON Semi Signs Long-Term EV Deal with BMW

The transition to electric vehicles is an amazing growth story, but the big opportunity for investors is in chips and chargers. Jon Markman points to one company that should see outsized earnings as a result.

Social Media’s Shocking Role in SVB’s Failure

A social media bank run caused mayhem last weekend, raising doubts about the U.S. banking system and the Fed’s crusade against inflation. Analyst Kenny Polcari explains.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily