|

| By Jordan Chussler |

The market’s limbo continued this month, with the S&P 500 remaining in the same range it has been stuck in since November of last year.

Since November, the index has broken above its 200-day moving average — the threshold of bull and bear markets — on five different occasions but has failed to remain north of that mark for any significant period.

Click here to see full-sized image.

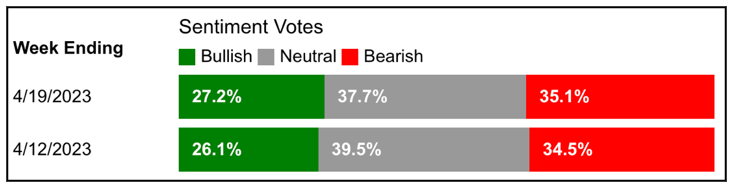

As the index remains rangebound, it has directly correlated to investor outlook, which according to the AAII Investor Sentiment Survey, is predominantly neutral for the second week in a row.

Click here to see full-sized image.

However, referring to the above price chart, the S&P 500 has put in a double bottom pattern within its range, which is typically indicative of bullish price action.

As earning season progresses, we could get more clarity on which direction the index is headed.

However, as Senior Editor Tony Sagami highlighted in his column this week, a certain indicator with a track record of 100% accuracy has recently been triggered, and if history maintains, there are plenty of reasons to be optimistic about market conditions moving forward.

Late Wall Street analyst Martin Zweig’s Breadth Thrust Indicator has only been triggered 14 times since 1950. Each time, the S&P 500 was higher a year later by an average of 23%. This week, Tony reports on how investors can take advantage of this latest instance.

Learn Our Strategies … from the Sources Themselves

In a year that’s proven unpredictable for the markets, the one constant has been how Weiss analysts and editors deploy safety-oriented strategies as well as opportunities to hedge with alternative assets. This year, you can meet them in person to learn more about their methodology and tailored picks.

How to Invest in the Rapidly Aging Population

By 2050, 2.1 billion people will be 60 or older, more than double 2015’s count. America is getting older faster. Senior Analyst Sean Brodrick explains how the rapidly aging global population presents an opportunity to invest in the sectors and companies that cater to senior citizens.

The Push for AI Makes This Company a ‘Buy’

ChatGPT launched in December, and by the end of January, the AI service had over 100 million users. Pulitzer Prize winner Jon Markman describes how one company’s graphics processing units were used to accelerate the capabilities of ChatGPT, which makes it a buy as the AI revolution takes root.

This Alternative Asset Blasted 40% Higher in Just Weeks

Income Analyst Nilus Mattive discusses why alternative assets are acting as the best hedges against inflation and volatile traditional asset markets, with one in particular surging 29% last year while nearly all other major assets were in the red.

Bet on This Consumer Staples Winner

Amid ongoing volatility, investors are on the lookout for resilient sectors. Assistant Managing Editor Mahdis Marzooghian explains why the consumer staples sector performs well even during periods of elevated inflation and recommends one company that routinely beats earnings expectations regardless of broad economic conditions.

Our Stock Screener Reveals 2 Gems in 2023’s Strongest Sector

Investors shouldn’t rely on broad indices like the S&P 500 as an investment unless they want to stunt their portfolio’s growth. Senior Investment Writer Karen Riccio details how to use the Weiss Ratings screener to reveal stocks with strong ratings that belong in your holdings.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily