|

| By Jim Nelson |

Don’t you miss the days when good news could just be … a good thing?

This week’s nonfarm payrolls report shows employers added 336,000 jobs last month. That’s up from an already upwardly revised August number of 227,000.

Good, right? Well, you already know.

The Wall Street Journal led with the headline “Hiring Surge Keeps Door Open for Fed to Increase Rates.”

Of course, this is likely. But it is already something we knew before the new numbers.

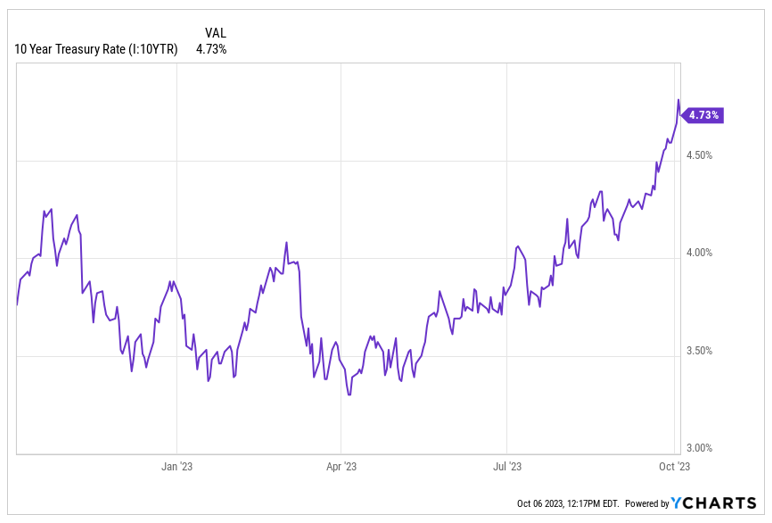

This pairs pretty poorly with this:

This is a chart of the interest rate on 10-year U.S. Treasury notes. It actually got worse than this, hitting 4.86% yesterday morning.

This is all on top of a leaderless House of Representatives weeks before the next shutdown deadline. Man, what a week!

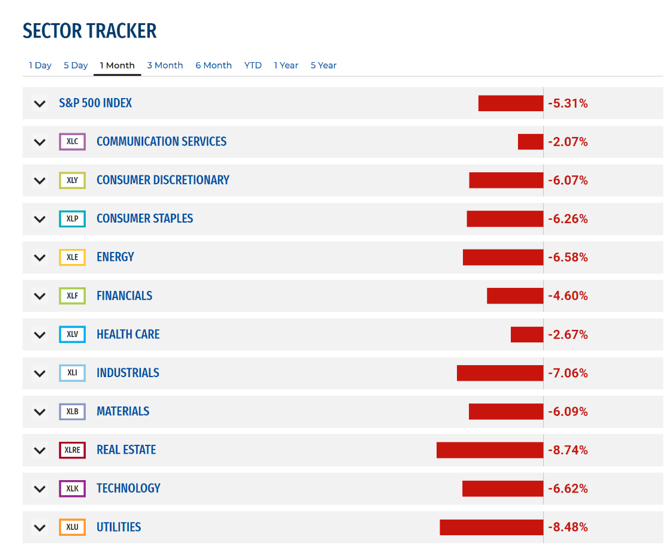

So, where should everyone go to find safety? Well, not many places. Bonds are clearly out. What about equities? Sadly, no …

I’ve shared similar charts in the past. But this one is almost sinister.

Not a single sector is up over the last month of trading. Some, like utilities and real estate are falling apart. And those are supposed to be safe!

Of course, there are winners to be found. And our team of editors and analysts have been on the case to find them. Here’s what they have to say …

Dr. Martin Weiss, founder of Weiss Ratings, shares a scary scenario … one that could happen starting in just a few weeks. He also tells you the dirty little secret about the “pros” on Wall Street. Fear not! He offers a solution to it all.

Auto Stocks Are Too Bloody Risky to Own

Our ratings guru, Gavin Magor, digs deep into why auto stocks have always underperformed. With their valuations nosediving due to strikes, investors may wonder if they are cheap enough to buy now. Gavin shares why that’s a terrible — or “bloody terrible,” as he’d say — idea.

With the S&P 500 diving down to its 200-day moving average, Senior Investment Writer Karen Riccio takes you behind the curtain and shares the most useful tool in investing. Moving averages tell a much larger story than just which direction a stock, ETF or index has been heading. They can offer real insight into where they will go.

Tech Juggernauts Tell DOJ to ‘Bring It’

Tech trader extraordinaire Jon Markman dispels the fog surrounding the legal problems of Big Tech. There’s a reason regulators haven’t been able to pin the likes of Alphabet (GOOGL) and Amazon.com (AMZN) down with more than wrist-slap fees. Big Tech already won!

Martin is back with an update on the crash in the bond market. With prices crashing, yields are skyrocketing … which is bringing everything down around us. There is a way to avoid the fallout, however. He shares it in this article.

With the market the way it is, everyone is looking for Gavin’s three favorite things: safety, stability and sanity. He shows you a foolproof way to add all three to your portfolio. “Buy”-rated, rising stocks in the Weiss Ratings system are where you should start. He then shows you a few more tricks to do a little due diligence of your own.

That’s it for this week.

Until next time,

Jim Nelson

Managing Editor

Weiss Ratings Daily