|

| By Jim Nelson |

It’s already been a big year for IPOs.

And this week’s newest one piled on the gains for early investors.

In case you missed it, an AI-driven design platform company named Figma (FIG) began trading on the NYSE this week.

And it put on quite a show.

After moving up its initial price five times from $25 to $33 per share, FIG finally hit the Big Board.

Immediately, shares traded hands at $90. A day later, they reached a high of $142.92.

That’s a 330% rise from where they were priced just over 24 hours earlier.

It’s not alone. IPOs have been hot.

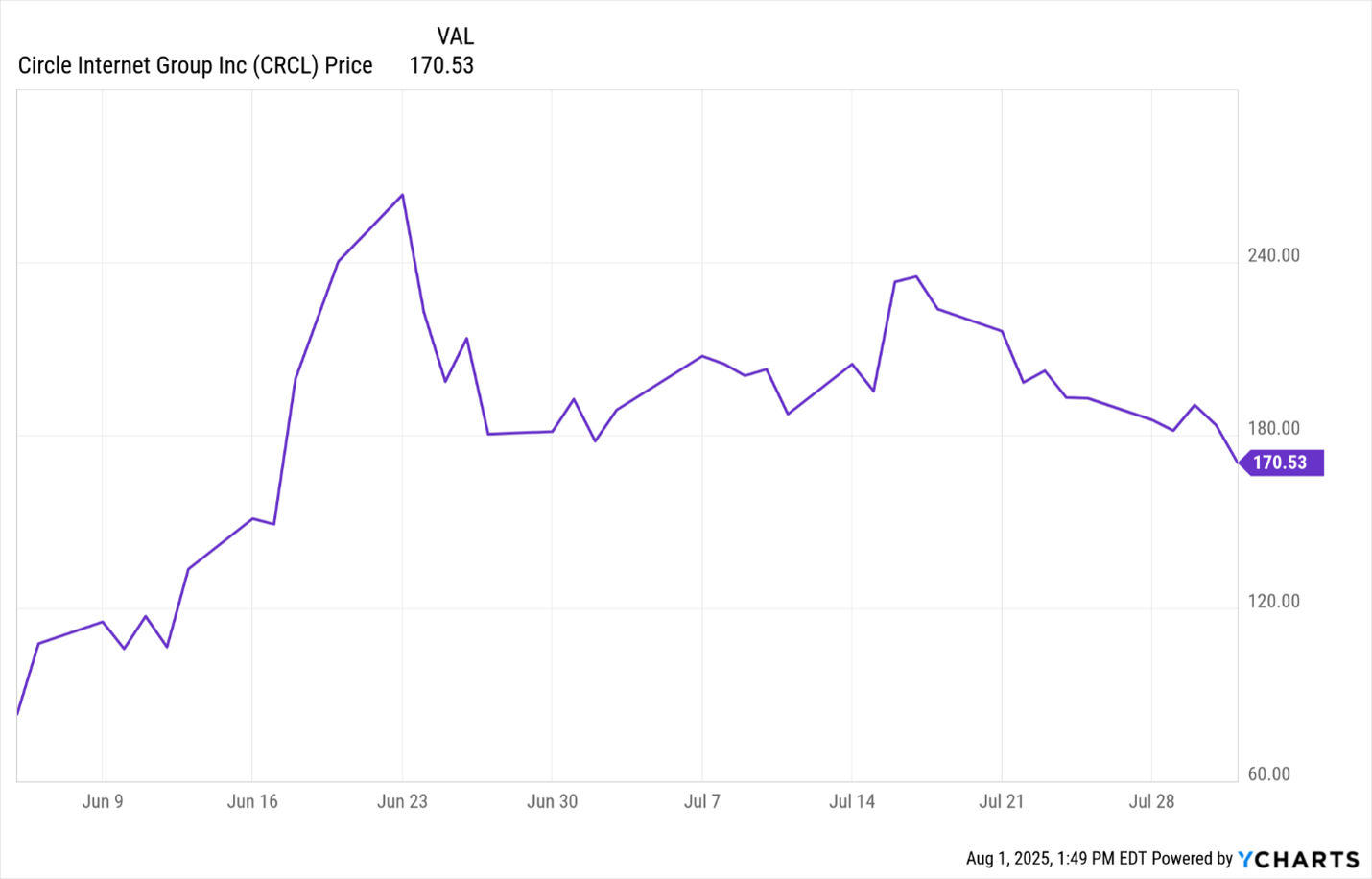

We’ve commented on Circle (CRCL) before.

In fact, your Safe Money expert, Nilus Mattive, gave you plenty of reasons why it ISN’T the IPO to place your money on.

You can see its remarkable post-IPO rally above $240:

Sure, shares have cooled off — which is what Nilus predicted — but the stock is still trading well above where it debuted on June 5.

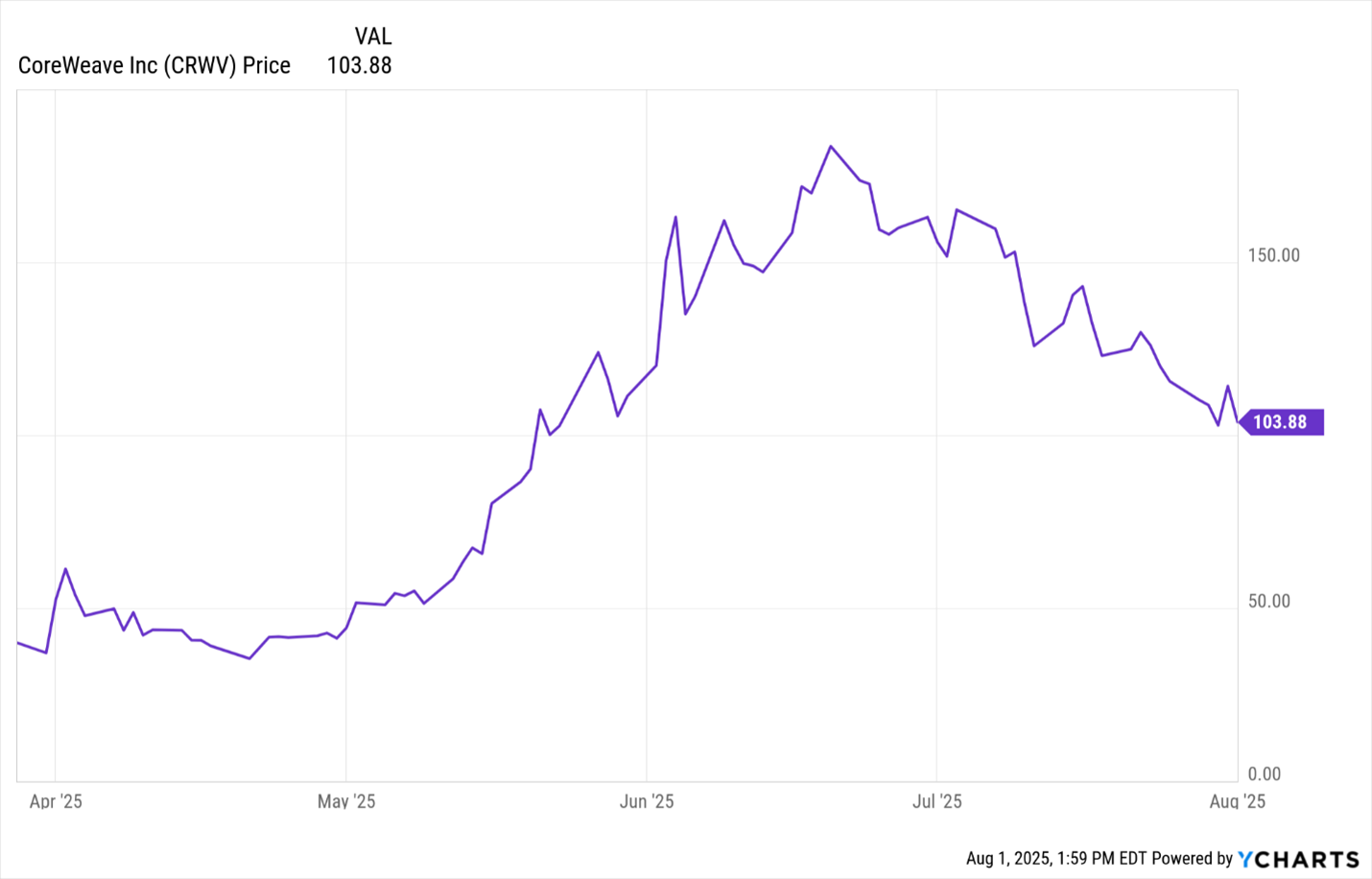

CoreWeave (CRWV) was another hot IPO.

This AI company was priced at $40, which was actually lower than the $47-$55 range many analysts expected.

Though it didn’t take long for those freshly traded shares to skyrocket above that initial range:

While those early investors had a chance to make some serious money in a short amount of time, you have the chance to do much better than them.

IPO investors can do quite well, as we saw.

But it’s the earliest investors who stand to make fortunes when a company goes public.

We call that the “Alpha Round.”

It’s a little-known stage after startup founders and their friends and families invest …

And before venture capital and other big-dollar investors get their shot to buy in.

Now, not every startup hosts an Alpha Round. Nor does every startup make it to the IPO stage, either.

But the ones that do can change the lives of not just the founders, but also their Alpha Round investors.

In fact, the IPO doesn’t even have to crush it like Figma, CoreWeave and Circle for Alpha Round investors to do well.

In another case, Alpha Round investors made returns of over 900% … even when the stock went down after the IPO.

For many decades, this form of investing was off-limits to everyone but angel investors and VCs.

Not anymore.

Legal reforms have opened up Alpha Round investing to just about everyone. No accreditation required.

But the process for investing pre-IPO is a bit different than simply entering a ticker and pressing “Buy” on your brokerage platform.

It takes real know-how. Which is why you should watch this.

Your startup specialist, Chris Graebe, just found a company that could do even better than the above three.

And you can buy it even before venture capital investors … and way before it IPOs.

But you need to hurry. This fundraising round is almost full. Check out the details here.

Of course, you can still bank gains the conventional way. And that’s exactly what your experts are best at.

Here’s what they are talking about right now …

How Trump Is Changing Retirement Planning

There’s a new retirement account every parent needs to learn about: The “Trump Account.” Nilus digs in and shares what he found.

A Rare Opportunity to Own a Life-Changing Tech Startup

Back to early investing, Michael A. Robinson makes the case for it, too. He takes a look at a company that saw post-IPO gains of more than 1,300%!

The Rodney Dangerfield of Investments

“No respect.” That’s what Sean Brodrick thinks the market is giving biotech companies. And who doesn’t love a good underdog story? Here’s how he recommends you play their recovery.

Director of Ratings and Research Gavin Magor returns to a list that helped readers make a great deal of money over the last year. It’s now updated and is giving two stocks even better odds of becoming major winners.

One Ticker to Profit from NATO’s New Spending Surge

Michael is all about the American Tech Renaissance that’s going on in everything from AI to the New Space Race. But he is also targeting European defense companies. Here’s how to get in with a single ticker.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily