|

| By Jim Nelson |

Oil remains the asset with too many catalysts.

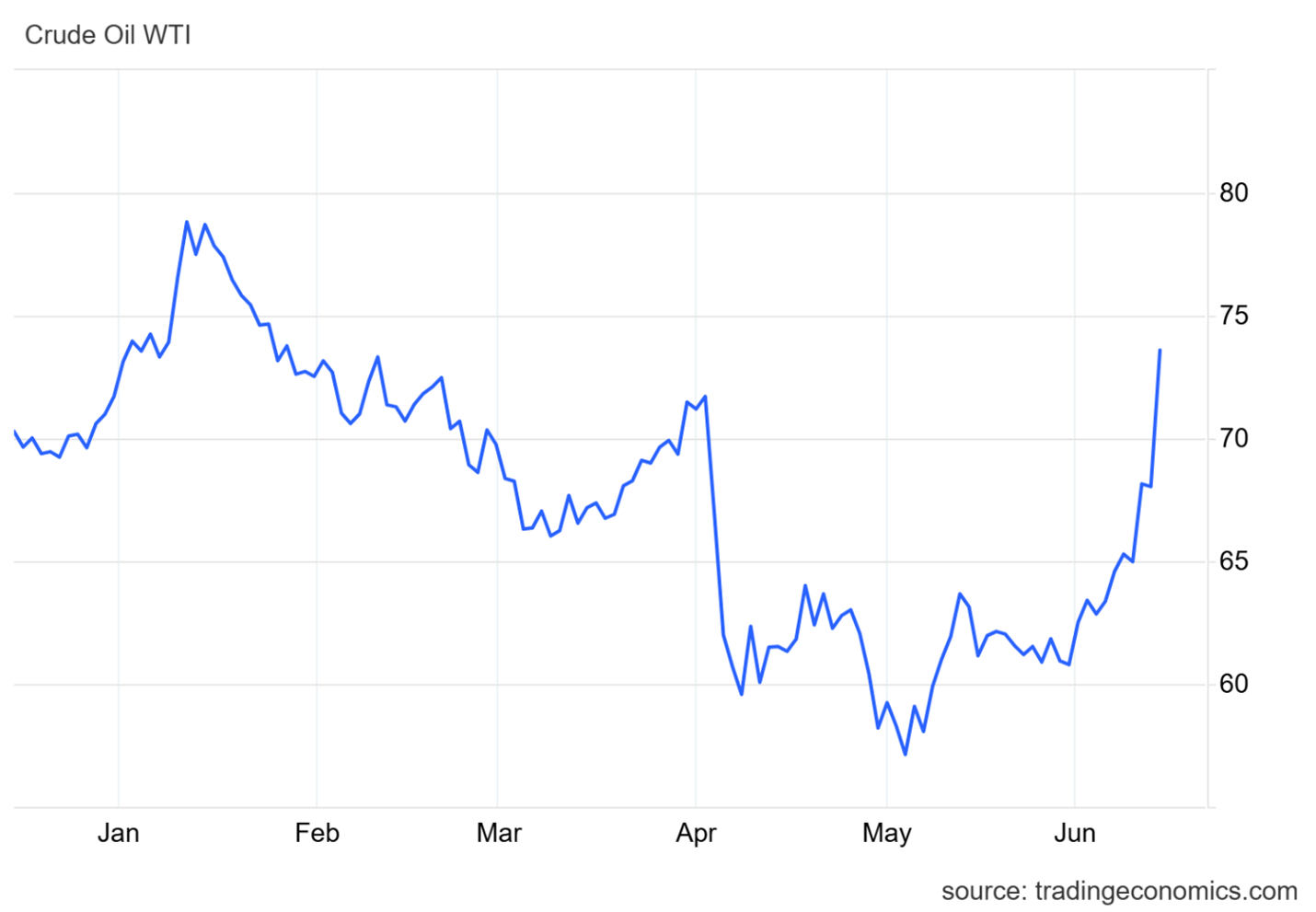

For most of 2025 so far, oil prices have fallen on tariff troubles and recession worries.

Historically, when the global economy starts to slide, you don’t want to be anywhere near energy companies … especially oil and gas producers.

But yesterday, we were reminded that oil isn’t just a proxy for the economy.

It is a product that is ultimately traded based on its supply and demand.

Israel’s attack on Iran wasn’t specifically targeting Iran’s massive oil infrastructure …

But it appears the attacks on its nuclear facilities could only be the first step.

While the U.N. is urging restraint, this current Israel-Iran conflict could last weeks.

And IF Israel targets Iran’s most important resource — its oil production — it could send oil even higher.

And it already jumped …

Oil shrugged off the macroeconomic worries it’s been burdened with year to date in mere minutes.

Thursday night here in the U.S., when Israel’s attack began, crude prices shot back up to where they began 2025.

So, this is a good reminder to stay diversified. Energy stocks should remain a part of a well-balanced portfolio.

Your experts have plenty more for you to have allocations in, too. Here’s what they are suggesting:

Burry, Buffett & the New ‘Age of Chaos’

You know when the world’s most famous optimist and its most infamous pessimist agree on something, you need to listen. Nilus Mattive has a story you need to read.

How to Find the Best Tiny Stocks

If gains of 18,000% and 147,000% don’t interest you, then you probably don’t want to see what our director of ratings is looking at this week. Gavin Magor studies our smallest “buys.”

The 2 Most Important Charts in Precious Metals Right Now

Resource guru Sean Brodrick has two charts that show the rally in precious metals is definitely not over. And he also has the perfect way to play it.

The SEC Just Gave This ‘Other’ Blue-Chip Digital Currency a Boost

The doors between traditional finance and digital currencies are breaking down. And Crypto Income Analyst Marija Matić knows how to profit from it.

Backdoor AI Winner of Fannie & Freddie’s Reprivatization

Even if White House plans to reprivatize Fannie Mae and Freddie Mac don’t materialize, Michael A. Robinson has a fintech titan that is quietly dominating its sector.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily