|

| By Jim Nelson |

With volatility now here to stay, a new pattern has emerged that could help soften the pain of short-term stock routs.

To understand it, we need to revisit a topic we’ve covered before … Warren Buffett’s love of cash.

Three weeks ago, we told you Buffett’s Berkshire Hathaway (BRKB) set a new record for most cash on hand by any company since records began on the stat.

Well, it turns out cash can actually lead to higher prices under the right circumstances.

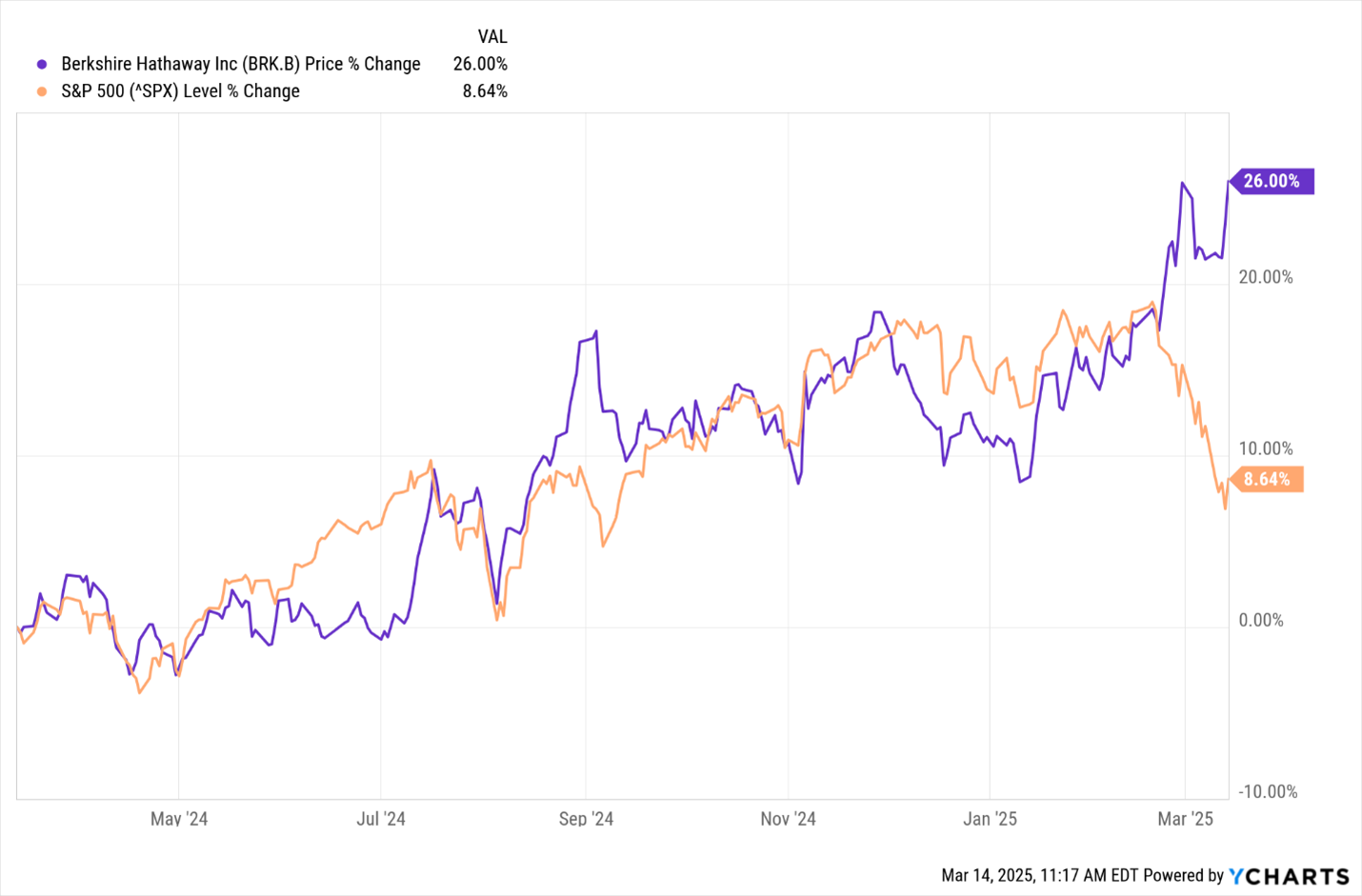

This chart shows that whenever the rest of the market experiences downturns, Berkshire booms:

There’s another reason for this. It’s also because of that volatility we just discussed last week.

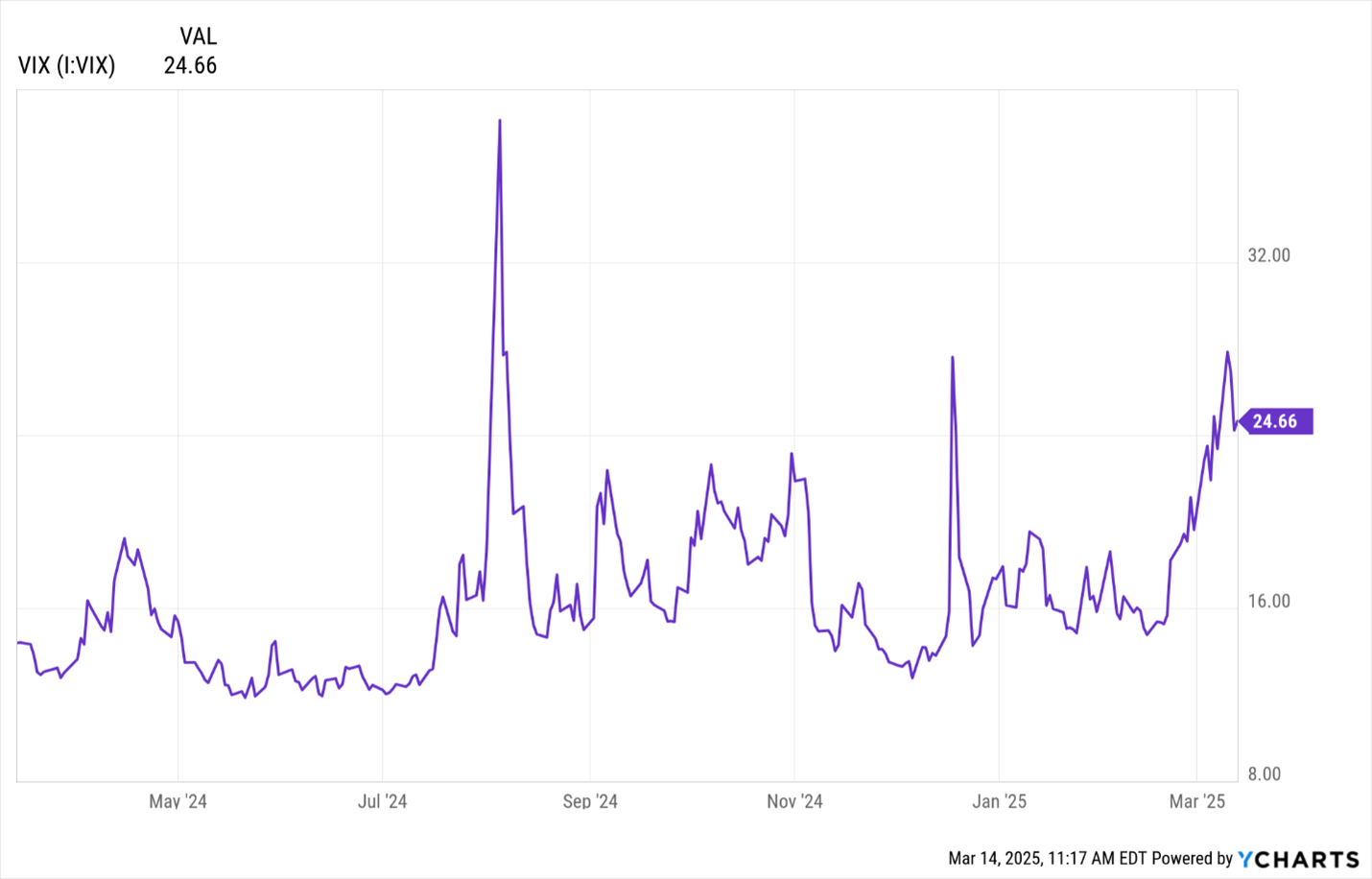

Here’s the VIX during the same time frame as the above chart:

As you can see, when volatility is low, the S&P 500 jumps out ahead of Buffett’s cash-heavy holding company.

But when volatility spikes, like in August 2024 and the past two weeks, BRKB breaks out.

So, the best way to even out the pain of a stock-heavy portfolio might not actually be holding cash itself. It’s to buy another stock!

You might want to consider owning BRKB, which holds cash for you AND offers gains.

There’s another asset class you should consider. Here’s a chart that was shared recently during an editor’s meeting here at Weiss HQ:

As you can see, private markets offer protection even more than the public companies that invest in them. You want to own private businesses directly when the market turns ugly.

That’s why you need to see what our private equity specialist, Chris Graebe, just unveiled.

There are, of course, other ways to protect and even benefit from wild markets like this. Here’s what your experts are doing for readers …

Readers Agree (and Disagree!) Over Social Security

Social Security may be a touchy subject. But you seem to agree with Nilus Mattive — even in part — that we must ask the tough questions. He listened and has more ideas.

An Energy Startup Just Aced My ‘FIVE’ Test

To the point above, private startups offer protection. But you only want the right private investments. Chris shares his “FIVE” test so you don’t invest in the wrong ones.

Why Gold Is Shocking the Market

Gold recently hit $3,000 per ounce. Sean Brodrick called that a year ago when few would have foreseen this milestone. Now, he has exactly what you need to play it.

The Startups That Keep Your Lights on

The energy market has changed. And that’s created a giant problem. Chris has three startups with solutions to keep your lights on.

6x the Market with This Hidden Quantum Play

Michael has another “twofer” that offers access to all the upside of quantum computing and the “GE-split” multiplier that sent the American titan six times higher than the market over the past two years.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily