|

| By Jim Nelson |

The backdoor AI play that’s swept through Wall Street over the past year seems to have finally had its comeuppance.

As we’ve written many times here, the U.S. has a power problem.

While the AI buildout continues to drive the market higher, the need for electric power generation has never been greater.

After all, AI chips and the data centers that house them are power thirsty.

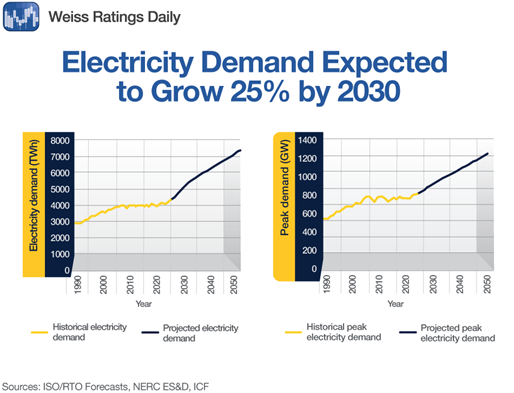

Here’s a chart Sean Brodrick shared a few weeks ago that shows what that new demand will look like going forward.

That’s why the utilities that produce that power have been flying for more than a year.

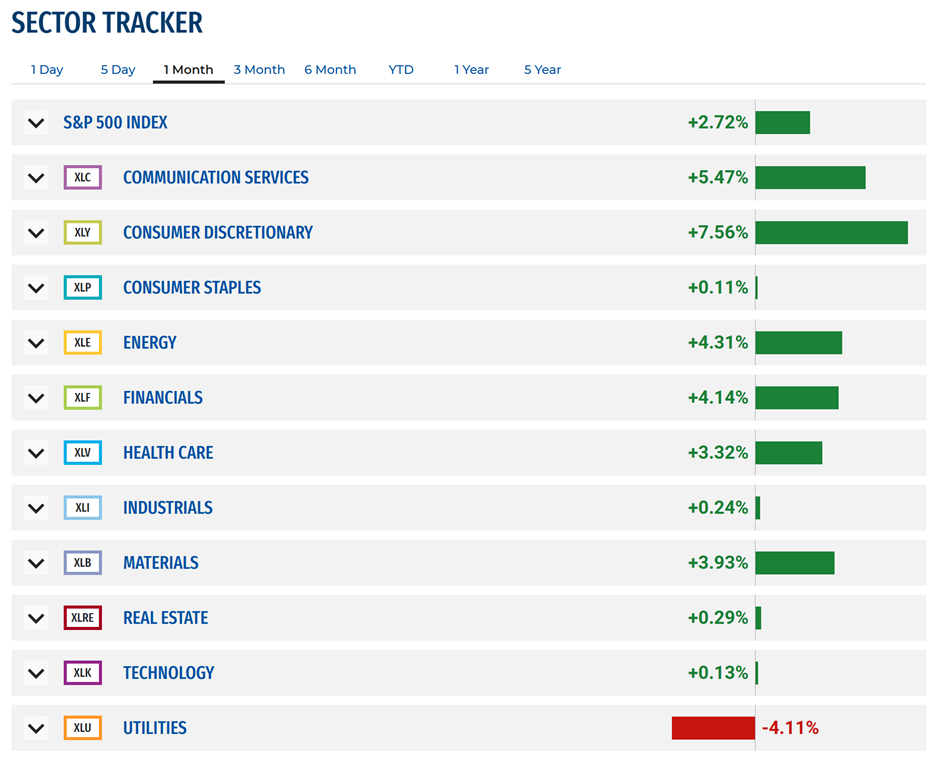

But with recent doubts about the longevity of the AI boom, this backdoor AI angle might be taking a break:

Over the past month, “utes” have tumbled. That was the only sector in the red during that period.

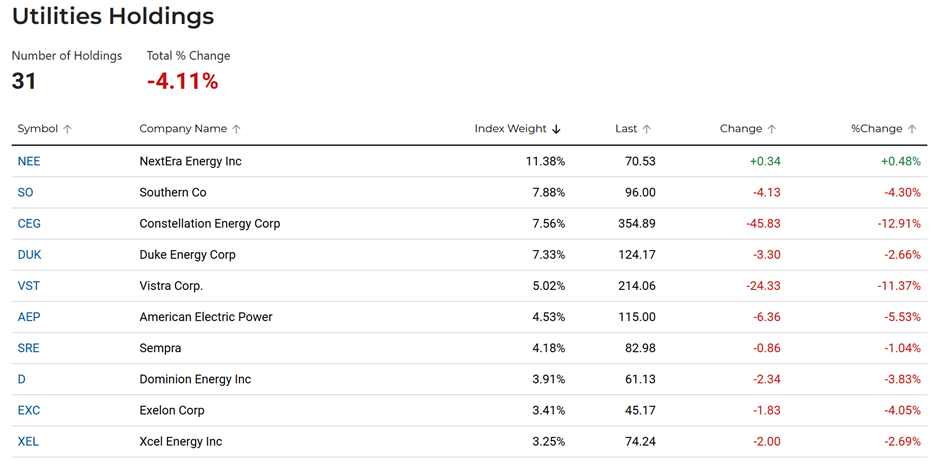

The companies that led this sell-off were the ones that rose the most on AI electric dreams:

Constellation Energy (CEG) and Vistra (VST) made headlines over the past year with deals to supply exclusive power to data centers over long time periods.

Today, they are starting to fall out of favor. But should they be?

The demand for new electricity doesn’t appear to be slipping.

We’ve also covered the capital spending the Mag 7 have planned for the next 12 months on building out AI infrastructure.

But there’s one more reason you might want to consider buying on this dip: Utes are income machines, especially when rates are cut.

Many compare utilities to bonds because of their large, predictable dividend payments.

But when fixed interest rates come down, it does two huge things for utilities.

- First, it makes their dividends all the more attractive compared to falling fixed rates on bonds.

- Second, it eases their high debt servicing costs to maintain and build out their networks.

For power generators like Constellation and Vistra, that means it will be cheaper to finance the work that needs to be done to expand power capacity.

That, in turn, means there’s more money at the end of the day to pay those dividends in the first place.

It’s a cycle that seems to be lining up for utilities right now.

With AI data centers still a booming business … and the Fed considering its first interest rate cut in a year … keep an eye on utility companies.

There are other trends that deserve just as much of your attention.

Here’s what your experts are recommending for you right now …

The Easy Fix for Social Security

With the U.S. government now taking direct stakes in individual companies (again), Nilus Mattive offers a slight alternative … one that could fix Social Security once and for all.

This Pattern Break Could Lead to Gains of 3x, 5x & Even 10x

Something major happened a few weeks ago. With the passage of the Genius Act, a surprise asset started rocketing higher. Now, Juan Villaverde says a new “season” is upon us.

3 Gold Charts Every Investor Needs to See

Gold just passed Treasurys as the largest held asset by foreign central banks. At the same time, gold is powering to all-time highs. Sean Brodrick has three charts and three ways to play them.

Budget Deficits Are Destroying Your Wealth

Budget deficits are a runaway freight train. They’re caused by creating more currency. Which is exactly what we’ll see if the Fed cut rates as expected on Sept. 17. Bob Czeschin has the way to play it before the Fed meets.

The AI Cornerstone of a $145 Trillion Sector

The Fed’s looming decision is also shifting a massive $145T sector. That’s “T” for TRILLION. Michael A. Robinson has the backdoor way to grab your share.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily