|

| By Nilus Mattive |

Back in December, I told you why I wasn’t buying the whole “Digital Asset Treasury Company” story.

The story that firms like Michael Saylor’s Strategy (MSTR) and Tom Lee’s Bitmine Immersion (BMNR) have been pushing on investors.

I hope you listened to my warning.

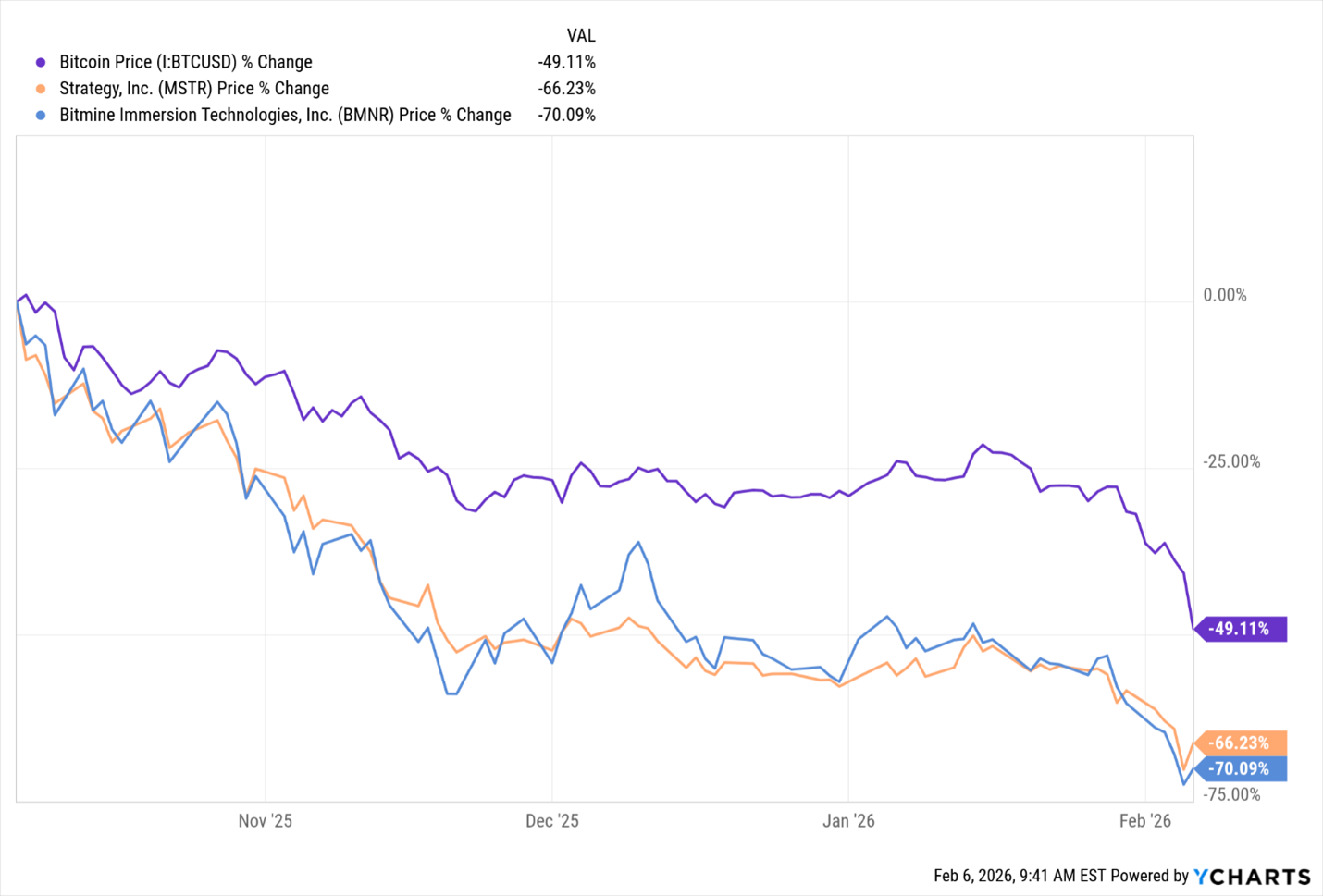

With Bitcoin now trading for half the price it was just in October, their business models have started to unravel just as predicted.

And the stocks have been dropping accordingly.

Indeed, MSTR has lost 33% and BMNR has dropped 46% in just the two months since I wrote my piece.

Since Bitcoin’s Oct. 26 high, they’re down 66% and 70%, respectively.

Then there’s Circle (CRCL), another stock that I first warned you about this past June.

It has now lost a full 71% in value since my original article!

Meanwhile, there are new signs that the AI bubble —which I have been talking about over and over again — is starting to leak serious hot air, too.

And I’ve still just scratched the surface of all the crazy things happening in the markets right now.

So with a lot of “risk on” momentum trades suddenly unwinding …

And other assets violently swinging up and down on a near daily basis …

A lot of investors are left asking what, if anything, they can still trust.

It’s funny because all this reminds me of my early days on Wall Street.

Back then, it was the original tech wreck … followed by the Enron scandal … that had investors feeling like nothing could be trusted anymore.

But I was lucky enough to have several much-older mentors at Standard & Poor’s.

Between the three of them, they had more than 100 years of collective experience on Wall Street and had literally seen it all.

For a guy straight out of college, working with them was the equivalent of getting a PhD in finance for free.

One of the most important lessons I learned there was this …

Companies will spin their results whatever way they can to keep investment dollars flowing in.

They’ll hire PR firms to write glossy releases promising the next big breakthrough is just around the corner.

They’ll invent new ways to measure their success. Including wacky financial measures that no actual business owner would use or rely on.

And in some instances, as was the case with Enron, they will commit outright accounting fraud to keep the charade going as long as possible.

So how can you know if a business is actually healthy and profitable?

Well, as one of my mentors told me back then, “You can fake a lot of things, but you can’t fake a dividend.”

It’s true.

A company can manipulate its numbers in various ways:

- Excluding one-time charges,

- Shifting revenue from one quarter to another, or

- Downplaying the effects of currency translations.

But if it promises regular payments, then it either pays them or it doesn’t.

And those can’t come out of thin air, either.

That’s still just a simplistic starting point for further research though.

For example, the aforementioned Bitmine Immersion (BMNR) recently began paying a token penny-per-share annual dividend.

Now, this does differentiate BMNR from other crypto companies.

And perhaps it convinced some investors that its business was viable.

Heck, it might have deterred some short-sellers from attacking it as well.

I’m not one of those investors.

I’d hardly let a tiny, new dividend like that convince me to buy any stock.

Let alone one from a company that isn’t even generating consistent profits!

In addition, collecting those paltry dividends would hardly make up for the massive drop in the stock that has been happening since I first warned you about it.

So how do you know if a company’s dividends are truly well-supported …

How can you determine if they’re not just well-supported but will keep INCREASING …

And is it possible to still get substantial capital appreciation out of the best dividend stocks — or do you simply have to settle for reasonable yields?

Tomorrow, in a special online presentation, Dr. Martin Weiss will give you answers to those questions and a whole lot more.

All you have to do is reserve your spot by clicking here.

This is a project that Martin has been working on feverishly for months. And I’m happy to say that I’m involved in it, too.

As you can guess, dividends are at the core of the project.

But they’re just a starting point for what Martin is calling the “Infinite Income System.”

I don’t want to steal all his thunder. So let me just say that it’s all about income-gushing stocks that have beaten the market 16-to-1 over the last 20 years — with total gains of 10,754% vs. 683% for the S&P 500.

So if you’re looking at the markets right now and wondering what you can still trust, my answer is the same one I gave back when I first started working for Martin 20 years ago … dividends.

And this new approach we’ve developed couldn’t be coming at a more appropriate time.

Hopefully you’ll come learn more about it tomorrow.

Just click here to grab your spot and get a reminder before the event begins.

Best wishes,

Nilus Mattive