When you say someone “bought the farm,” that’s usually bad news ... but now, it’s looking like a wise investment decision.

Because no matter where we are in the cycles, whether an economy’s in a recession or booming, or the world’s at war or at peace …

- People still need to eat.

Agriculture and farming are usually sound investments. That’s even more true as the global population keeps expanding.

- And now, with inflation heating up food prices, it may be one of the best investments.

However, buying a farm isn’t feasible for most investors. It requires a boatload of capital. And the costs of operating one — whether owned or leased — is substantial ... not to mention the time involved.

Fortunately, investors have other means to gain exposure to the sector beyond sinking money into a few hundred acres in Nebraska, several tractors and a harvester.

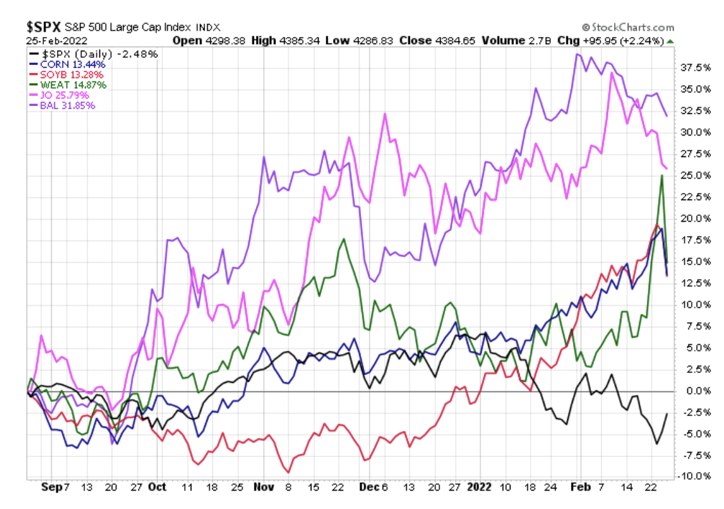

And over the past several months, investing in agricultural commodities — especially corn, soybeans, wheat, coffee and cotton — has been a lucrative adventure for many ... outperforming the S&P 500 (SPX) quite handily.

I covered exchange-traded products (ETPs) linked to various grains just last week.

But the closest you as an investor can get to owning a farm — without actually doing so — is by investing in a farmland-centered real estate investment trust (REIT).

These REITs purchase farmland and then lease it to farmers. Farmland REITs allow you to have stakes in multiple farms ... offer greater liquidity than owning physical farmland ... and obviously require FAR less capital.

The largest farmland REIT in the U.S. is Gladstone Land (LAND), formed in 1997 and holding 150+ mostly fruit and produce farms across 14 states.

- The total market cap of LAND is close to $1 billion, making it the largest farmland REIT in the world.

LAND currently offers a dividend yield of 1.93%. Daily market volume is decent, too, at 337,000 shares per day.

Why is volume important?

Because it’s just as important to be able to sell at a good price as buy at a good price. And the higher volume is, the less spread there is between the bid and the ask.

Another choice is Farmland Partners (FPI).

It has a market cap of $532 million, and average volume is 344,000 shares per day. Its dividend yield is 1.69%.

And if you have interest in a more individual stock picking approach, I highly recommend you check out my Supercycle Investor service. Subscribers are sitting on open gains of 34% and 28%, just to name a few. For more information, click here now.

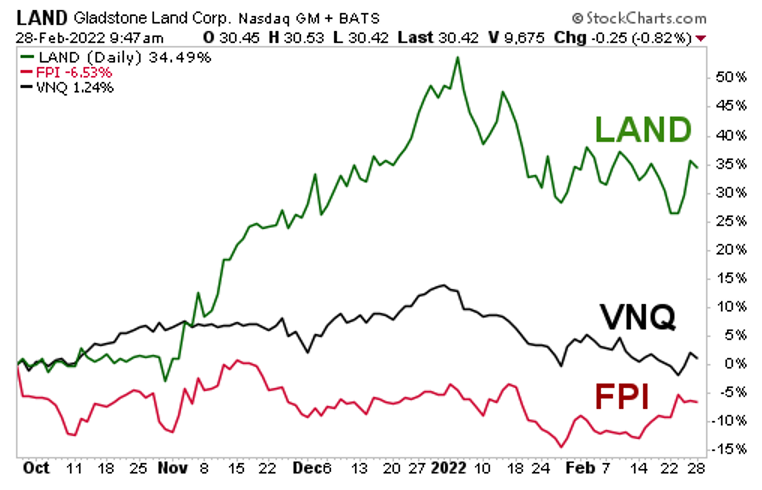

Here’s a chart comparing LAND and FPI to their benchmark, the Vanguard Real Estate Index Fund ETF Shares (VNQ).

You can see that LAND is beating them both by a country mile. And FPI is underperforming VNQ, showing that not every farm investment is a good one.

To be sure, always do your own due diligence before buying anything.

But if agricultural commodities are headed higher, it’s likely that farmland prices will follow.

All the best,

Sean