|

| By Jim Nelson |

While all eyes were on the behemoth tech stocks this week — as the government came back to life and AI valuations came under fire — a small, recent IPO made a splash … in the worst possible way.

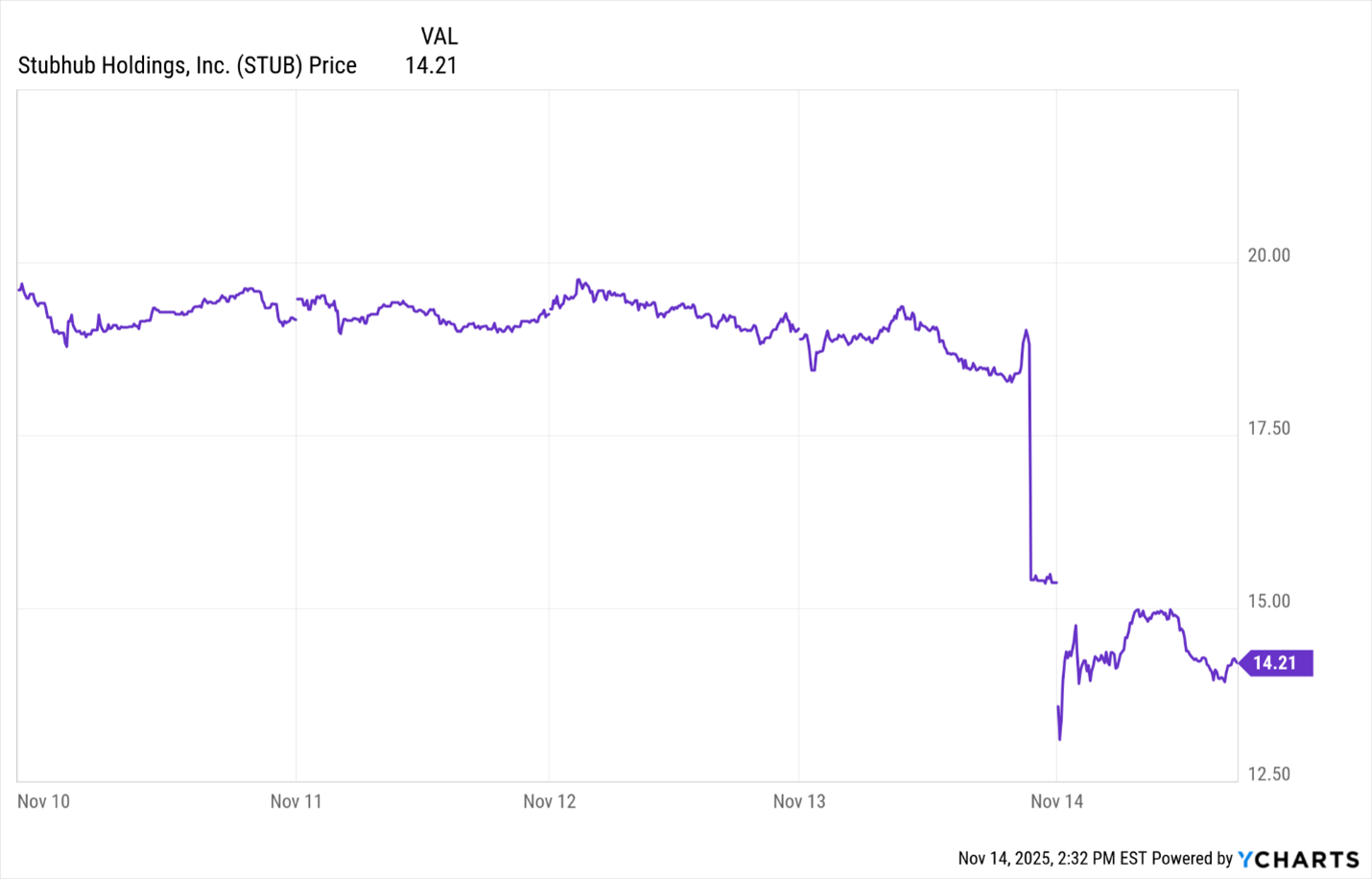

StubHub (STUB) announced its first quarterly earnings report as a publicly traded company.

If you aren’t familiar with the company, it is one of the major ticket resellers living in Ticketmaster’s shadow.

StubHub went public in September without much fanfare.

Shares ended their first day below their issue price.

Unfortunately, its first earnings report didn’t save the company … or its investors.

Shares plummeted 24% by lunch yesterday.

It was the perfect example of what not to do after a less-than-exciting IPO.

First, the company reported a net loss of $1.3 billion during the quarter because of $1.4 billion in stock awards for employees as part of the IPO.

Then, it announced that while ticket sales were up 11% compared to the same quarter in 2024, it would have been 24% if you exclude the impact of Taylor Swift tickets last year. So, expect a rocky road when she’s not touring.

Finally — and worst of all — it refused to issue guidance.

For a company so brand-new that was already under scrutiny — not to mention living in Ticketmaster’s shadow — investors didn’t like that.

To be fair, CFO Connie James said that StubHub will issue 2026 guidance … next quarter.

Now that the government is back open and the SEC can get back to work, we could see more IPOs again soon.

StubHub’s disastrous first showing during earnings season should hopefully be a wake-up call and a lesson to those new public stocks.

This is one area we’ll be watching closely, including your startup specialist Chris Graebe.

Expect to hear much more from him soon.

For now, another of your experts weighed in on a different IPO from earlier this year … one he warned you about back then.

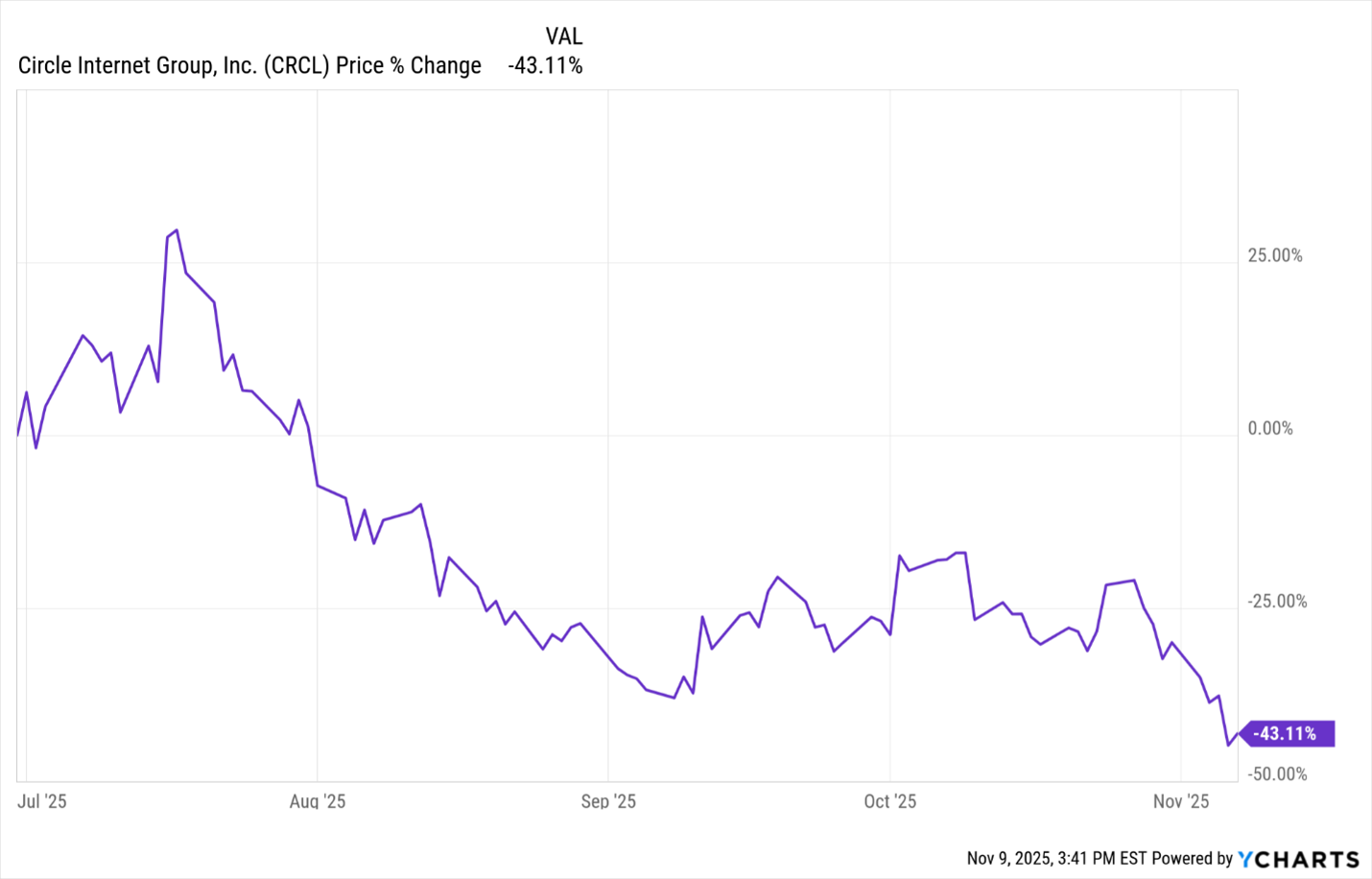

Nilus Mattive — your safe money specialist — has been tracking Circle Internet Group (CRCL) since its own public offering in June.

He’s even showed you how he planned to profit from his warning back then.

This week, he updated us on that …

“Here’s a chart of Circle from [my first article on CRCL] through now.

“As you can see, CRCL has dropped more than 40% since then …

“And my put position — which I just recently closed — produced a bigger GAIN than that.”

He pointed out two major reasons why “CRCL Is Circling the Drain” … and why it’s still a “Sell.”

He also pointed out “The Palantir Problem” this week. If you watched yesterday’s incredible “buy the dip,” you’ll want to read what he has to say.

Others are not so bearish. In fact, three of your experts like very different parts of the market.

Sean Brodrick says that “Metals Heat Up as the Shutdown Looks to Wind Down.”

He gives plenty of reasons for why both gold and silver should be in your portfolio following this shutdown.

Gavin Magor looks at a twice-proven screen of his to give you the latest results. He found “3 Newly Upgraded ‘A’-Rated Stocks.”

Finally, your tech guru, Michael A. Robinson, brings back some ancient knowledge from his trip to Greece — “From Ancient Wine Service to a $376B Industry.”

That’s it for this week.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily