|

| By Jim Nelson |

Over the past several weeks, we have been tracking a distinctive shift in U.S. policy.

No, we’re not talking about talk shows …

Or armed soldiers in cities …

Or even the ongoing trade wars.

Instead, we’ve been covering federal spending.

I’ll grant you that the federal government spending a lot of money is nothing new. But the how of it has changed.

A few weeks back, Sean Brodrick told you about a company he had previously shared with his Resource Trader readers:

“In July, MP Materials (MP) signed a significant partnership deal with the U.S. Department of Defense (DoD) aimed at accelerating American independence in rare earth magnet production.

“The DoD became MP Materials’ largest shareholder through a $400 million stock purchase. This gives the government a 15% stake in the company.

“The DoD guarantees a 10-year price floor for NdPr oxide at $110 per kilogram, nearly double current Chinese market prices.

“This deal ensures financial stability for MP Materials even if global prices drop.

“Simultaneously, the DoD signed a 10-year offtake agreement for 100% of output from a major new magnet manufacturing facility that MP Materials is building.

“That new factory should begin operations in 2028 and add 10,000 metric tons of NdFeB magnet-making capacity, which is vital for defense and advanced technologies.

“This makes the U.S. government a major financial backer and customer of MP Materials.”

About a week and a half later, Nilus Mattive pointed out the U.S. government’s recent deal with Intel (INTC).

Of course, in his way, Nilus suggested a better way for the U.S. to “invest” in public companies:

“So, yes, President Trump is 100% right that the U.S. government should be thinking more like a business-minded investor.

“However, it shouldn’t be doing that in a haphazard way that actively picks winners or losers … that reeks of “backroom bro deals” … or that takes place in some separate sovereign wealth fund with an unclear purpose.

“The simple solution is to start with broad equity investments inside the Social Security system.”

In both cases, however, the deals sent shares of these hand-selected government investments higher in a hurry.

MP is up 135% since the start of July, before its deal.

Intel is up nearly 30% since its more recent deal.

Now, just this week, it looks like the administration put its thumb on the scale for another group of stocks.

In this Wall Street Journal piece, Brian Schwartz and Gavin Bade report that Trump’s administration is looking to keep investing directly in a number of industries:

“Under the plan, the administration would use money from a $550 billion investment fund established as part of trade negotiations with Japan to invest in the development of semiconductors, pharmaceuticals, critical minerals, energy, ships and quantum computing.”

The last might seem out of place. But it comes right after we saw other pieces of the administration step up with their own cash.

Quantum Computing (QUBT) announced during its most recent quarter that it was awarded a subcontract to support NASA’s research center.

And on Thursday, Rigetti Computing (RGTI) announced a separate deal with a $5.8 million contract from the Air Force Research Laboratory.

These two — along with IonQ (IONQ) and D-Wave Quantum (QBTS) — are leaders in the development of quantum computing.

They are getting contracts, just like rare earth miners and Intel did before their direct investment deals.

Could quantum stocks also get direct investments from the U.S.?

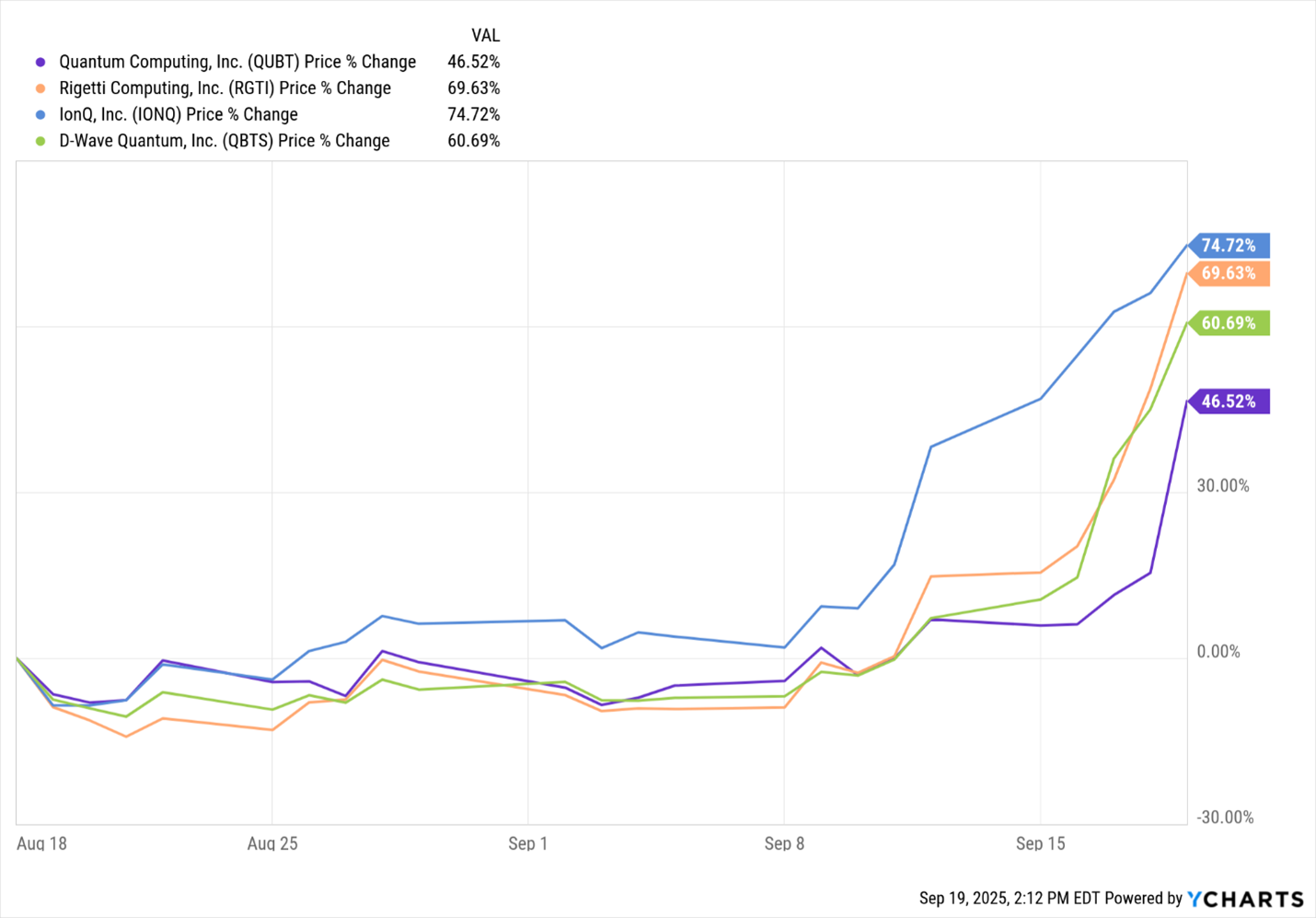

Investors seem to think so:

This story isn’t over yet. It’s not the first time these quantum stocks popped higher in a hurry.

The last time didn’t end great.

But it is definitely one we’ll keep watching. Here’s what else your editors are watching …

Where to Stash Your Cash Right Now

I know Nilus is not likely to take the bait and buy quantum stocks just yet. He still recommends holding cash with prices for everything still sky high. And he has some good ideas on where to stash it.

Michael A. Robinson is looking up to find your next winner. And he found it in this company with a track record dating back more than a century.

Mining Legend Explains Why You Should Buy Gold Now

Sean Brodrick is back from his precious metals conference in Colorado. And he brought with him an interview with a legend to add another voice to gold’s bull rally.

SpaceX: The Hottest Stock You Can’t Own

Startup specialist Chris Graebe is happy that more access is opening up for private investment. He just doesn’t like this one. But there are alternatives.

Dollar’s Doom Can’t Stop the ‘New American Wanderlust’

Michael follows up with the second half of his “twofer.” The space company is also the most important aerospace “buy” right now.

That’s it from us. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily

P.S. Michael’s century-old pick to lead the New Space Race isn’t the only way to play it.

In fact, it’s not even his favorite. Come to Tuesday’s Tech Summit to hear about four much smaller ones with even higher potential.