Weiss Ratings Daily

Sign up for free. Then check your inbox each morning for uncommon wisdom from the Weiss Ratings experts. All independent, unbiased and accurate. All grounded in our ratings of 53,000+ companies and investments. All to help grow your wealth in good times and bad.

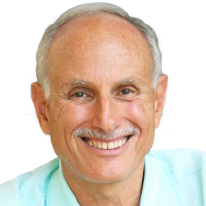

About the Editor

Dr. Weiss is the founder of Weiss Ratings, the nation’s leading provider of 100% independent grades on stocks, mutual funds and financial institutions, as well as the world’s only ratings agency that grades cryptocurrencies. He founded his company in 1971, and thanks largely to his strict independence, has established a 50-year record of accuracy. Forbes called him “Mr. Independence.” The U.S. Government Accountability Office (GAO) reported that his insurance company ratings outperformed those of A.M. Best, S&P and Moody’s by at least three to one. And The Wall Street Journal reported that investors using the Weiss stock ratings could have made more money than those following the grades issued by Merrill Lynch, J.P. Morgan, Goldman Sachs, Standard & Poor’s and every other firm reviewed.