|

| By Jim Nelson |

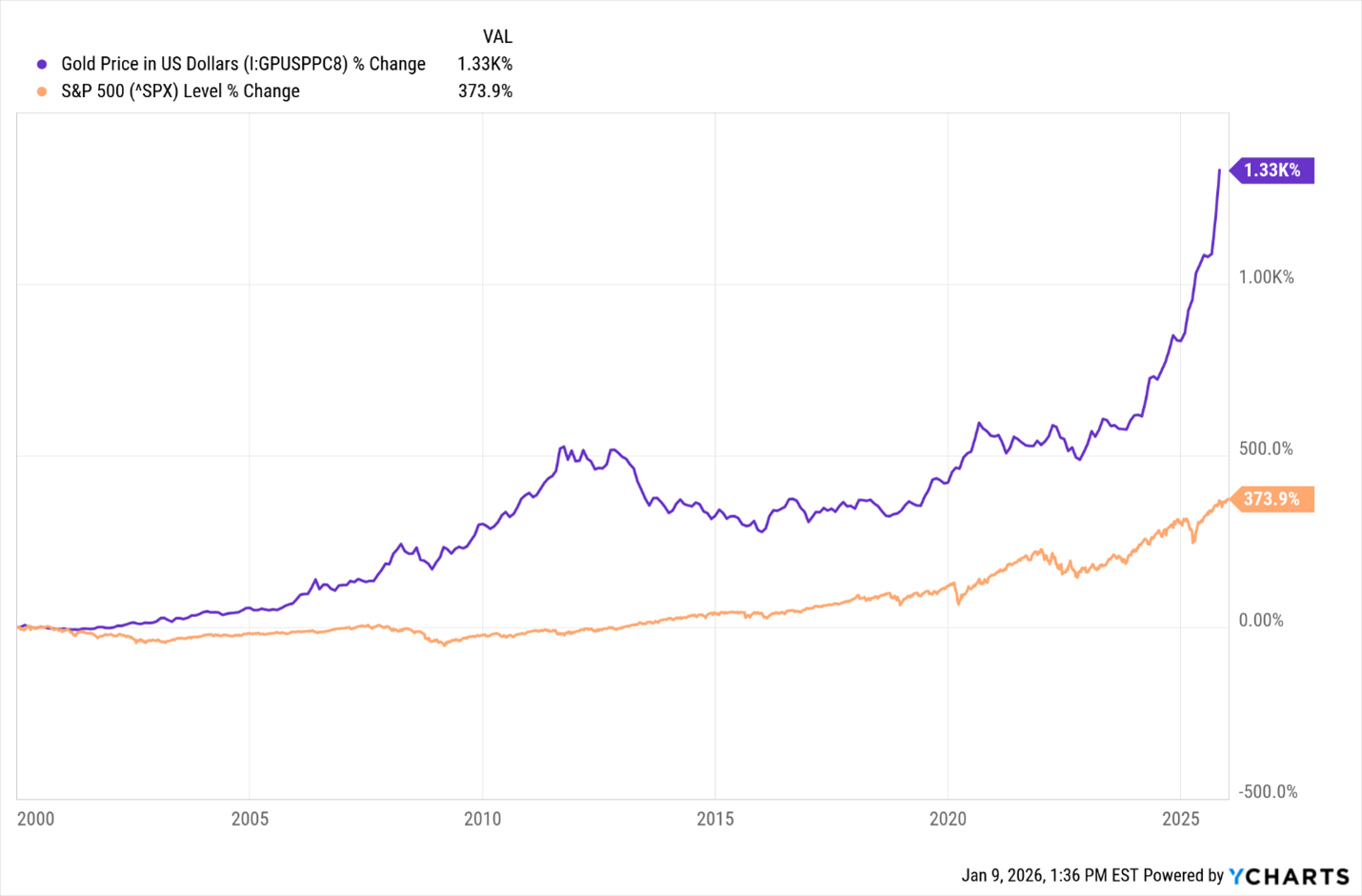

One year ago, we looked at the long-term performance of gold and the S&P 500.

What was shocking last year should now be common knowledge.

Gold has had a fantastic 21st century.

It was up 800% to end 2024, compared to 300% for the broad market.

Today, that split is even wider:

In truth, even this chart doesn’t show the full spread. Gold topped $4,500 again this week.

If it can hold above that price, there’s no stopping it from running higher.

If you’ve been following these pages for any length of time, you already know that many of your experts are calling for 2025’s gold run to be just the start.

Related reading:

Sean Brodrick just released his newest prediction on gold.

He calls it the “Golden Paradox.”

Of course, he and the rest of your gurus aren’t just calling for another big year for gold.

Here’s how they recommend you settle in for the new trading year:

Japan just hiked rates to a level last seen in 1995. Nilus Mattive warns of what this means for the market’s favorite companies.

2 Catalysts for Copper’s Breakout

There’s a perfect storm brewing for Dr. Copper. Bob Czeschin has the quickest and easiest way to play it.

4 Ways to Profit from the Danger Zone

If you’ve paid attention to the news over the past week, you might already know we’re in the Danger Zone. Sean has four ways to play his War Cycle readings.

Director of Research & Ratings Gavin Magor celebrates not only Warren Buffett’s retirement … but also how he became so successful at investing.

Top 3 Tech Trends (& Plays) for 2026

Tech guru Michael A. Robinson gives you his forecasts into where tech investors should have their money. He accompanies each with a way to play them.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily